Shares of Quantum Computing (QUBT) are down more than 14% in regular trading after the company announced the sale of 26,867,276 shares in an oversubscribed private placement. The company entered into a securities purchase agreement with institutional investors, priced at the market under Nasdaq rules.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The share price decline follows a 26.8% surge on Friday, September 19. Lake Street analyst Max Michaelis initiated coverage of QUBT with a “Buy” rating and a new Street-high price target of $24, implying 3.1% upside potential.

QUBT Attracts Strong Investor Interest

The private placement includes participation from several major existing shareholders, along with a first-time investment from a leading global alternative asset manager. QUBT expects to raise gross proceeds of $500 million, with closing expected to occur on or about September 24, subject to closing conditions.

The company plans to use the funds to fast-track commercial rollouts, pursue strategic acquisitions, expand its sales and engineering teams, support working capital needs, and cover general corporate purposes.

QUBT Wins a New Street-High Price Target

Michaelis describes QUBT as a “compelling way to participate in the rapidly growing market of quantum computing.” He acknowledges that the broader adoption of quantum computing is still in its early stages, yet believes that the company is nearing a turning point, with revenue expected to increase significantly in 2026 and 2027.

This growth outlook stems from ongoing industry advancements and Quantum’s early leadership, which Michaelis sees as positioning the company for continued expansion.

Michaelis is a five-star analyst on TipRanks, ranking #163 out of the 10,050 analysts tracked. He boasts a 90% success rate and an impressive average return per rating of 136.80%.

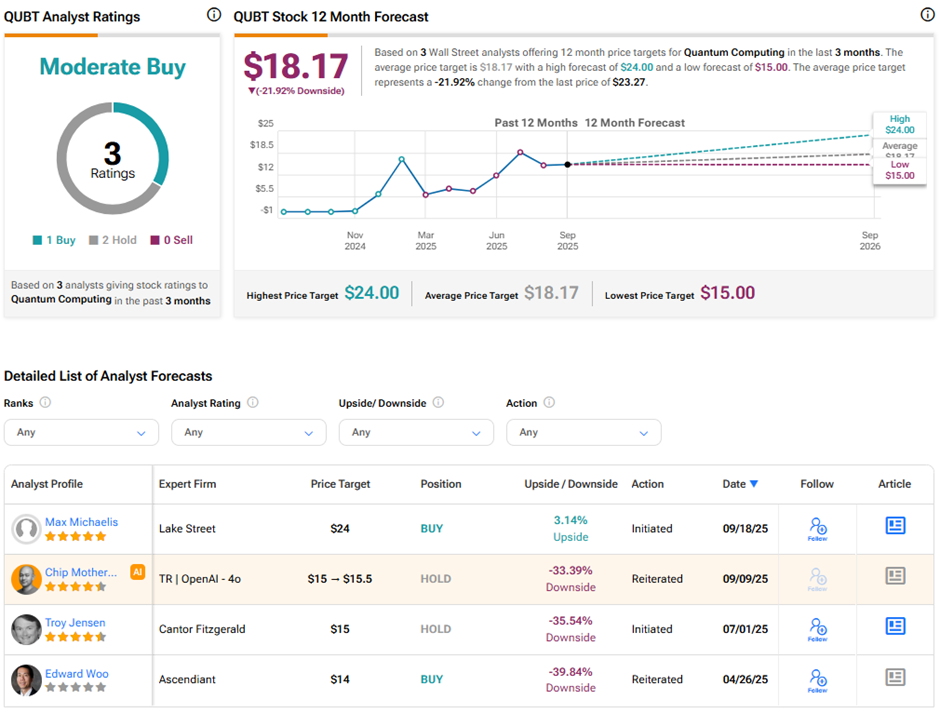

Is QUBT Stock a Buy, Hold, or Sell?

On TipRanks, QUBT stock has a Moderate Buy consensus rating based on one Buy and two Hold ratings. The average Quantum Computing price target of $18.17 implies 21.9% downside potential from current levels. Year-to-date, QUBT stock has gained 40.6%.