Prelude Therapeutics (PRLD) stock plummeted on Tuesday after the biopharmaceutical company announced an exclusive options agreement with biopharmaceutical company Incyte (INCY). This options agreement is related to Prelude’s mutant selective JAK2V617F JH2 inhibitor program in development for patients with myeloproliferative neoplasms (MPNs). These are a group of chronic blood disorders characterized by the overproduction of blood cells in the bone marrow.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Prelude Therapeutics noted that the options agreement has Incyte agreeing to an upfront payment of $35 million and an equity investment of $25 million. This will see Incyte acquire 6.25 million shares of PRLD stock for $4 per share.

Prelude Therapeutics will use the funds from this agreement to further develop the JAK2V617F JH2 inhibitor program to predefined milestones. During this time, Incyte has the option to acquire the program for $100 million. It will also grant Prelude Therapeutics up to $775 million from additional milestones, as well as single-digit royalties on global net sales.

Prelude Therapeutics Stock Movement Today

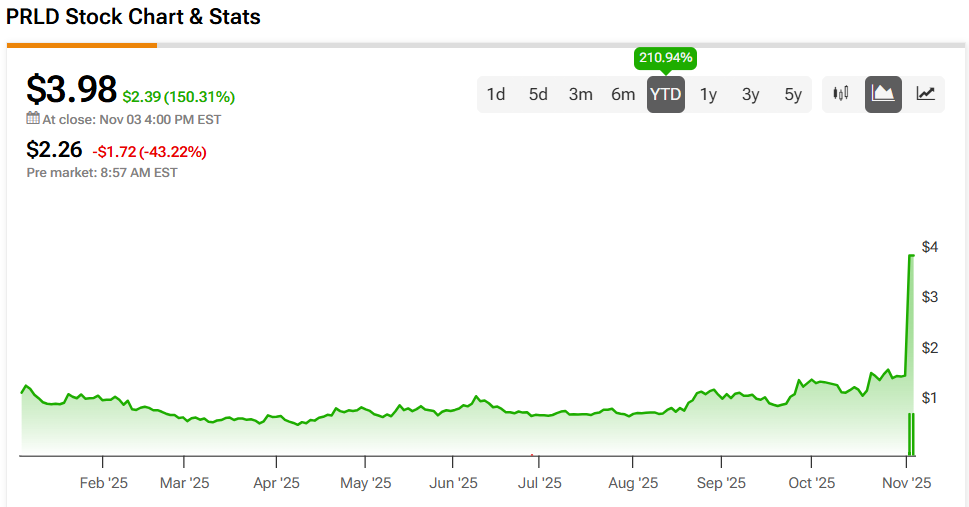

Prelude Therapeutics stock was down 43.22% in pre-market trading on Tuesday, following a 150.31% rally yesterday. The stock has increased 210.94% year-to-date and 208.53% over the past 12 months.

Today’s news brought heavy trading to PRLD stock, as some 10 million shares changed hands. For comparison, the company’s three-month daily average trading volume is about 256,000 shares. Trading volume was also elevated yesterday at 34.57 million units.

Is Prelude Therapeutics Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Prelude Therapeutics is Moderate Buy, based on two Buy ratings over the past three months. With that comes an average PRLD stock price target of $4, representing a potential 0.5% upside for the shares.