Shares of Opendoor Technologies (OPEN) rose over 3% in pre-market trading on Tuesday, extending Monday’s gain of more than 20%. Last week, the stock fell after a bigger-than-expected Q3 loss and a warning of larger Q4 losses. Later on, the stock rebounded as markets welcomed the expected end of the government shutdown. Investors are also reacting positively to a plan that rewards shareholders while making life harder for short sellers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Opendoor Technologies is a digital platform that streamlines the process of buying and selling homes.

Opendoor Hits Back at Short Sellers

A key factor behind the recent rebound is management’s dividend of tradable warrants, which is making short sellers think twice. A dividend of tradable warrants gives shareholders an option they can sell or convert into stock later, instead of receiving cash. This can boost investor confidence and support the stock price.

When the dividend is paid, short sellers must return the warrants to the original lenders of the borrowed shares. Some may choose to close their positions instead, buying back the stock and potentially driving the price higher.

For Opendoor, shareholders of record by 5 p.m. on November 18 will get three tradable warrants for every 30 shares they own. The warrants have exercise prices of $9, $13, and $17 and expire on November 20, 2026.

What Changes for Short Sellers?

Before this move, Opendoor’s share price reflected its expected future value. Now, it also includes the extra value from the tradable warrants. Until November 18, short sellers face a higher risk and could face bigger losses if the stock price rises because the warrants add extra value.

Additionally, if a short seller is short when the warrants are issued, they must buy and deliver the warrants to the original lenders, which can be both costly and complex.

Short Sellers Remain Active on OPEN

Opendoor’s shares have faced very high short interest, with over 20% of the float sold short in recent months. The company is dealing with significant challenges, including declining revenue, heavy losses, and weak fundamentals, giving short sellers a strong reason to bet against it.

With so many traders wagering that the stock will fall, Opendoor remains under downward pressure. However, this high short interest also creates the potential for a short squeeze if investor sentiment or the company’s fundamentals improve.

Is OPEN Stock a Good Buy?

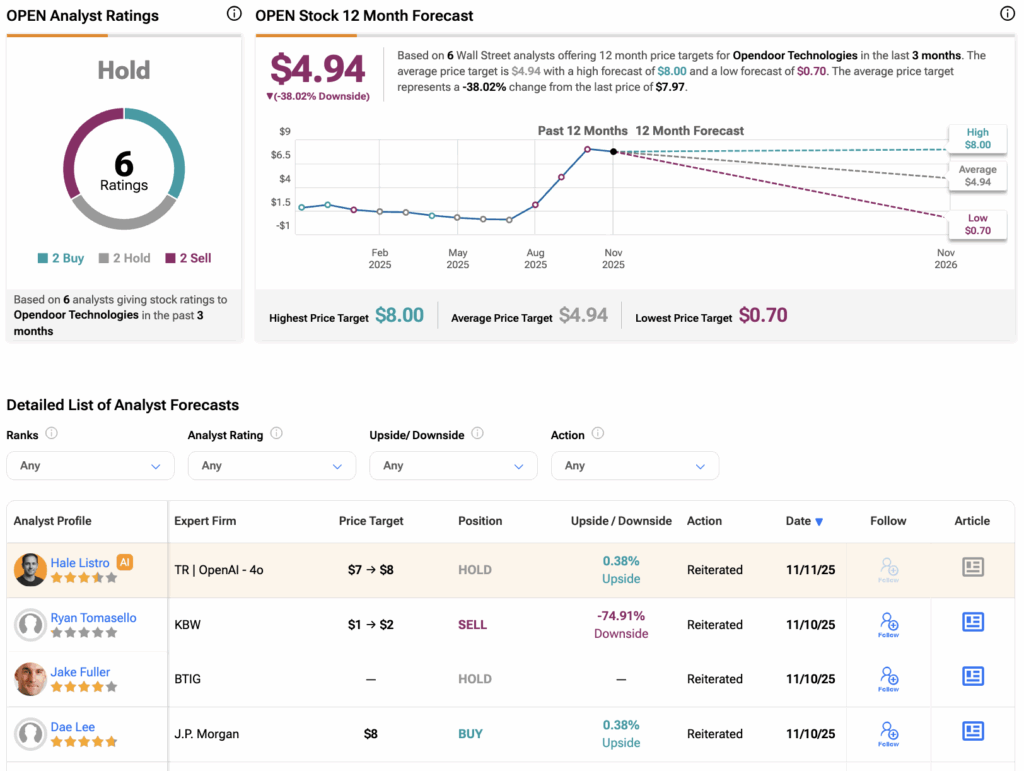

Turning to Wall Street, analysts have a Hold consensus rating on OPEN stock based on two Buys, two Holds, and two Sells assigned in the past three months. Furthermore, the average OPEN price target of $4.94 per share implies a 38.02% downside risk.