Nuburu (BURU) stock is rising, up over 30% in pre-market trading on Wednesday. The jump follows the company’s announcement of a binding agreement to acquire an Italian software firm, Orbit S.r.l. Investors are reacting positively, as the deal represents a strategic move to expand Nuburu’s Defense & Security Hub beyond laser technology. Following the announcement, BURU stock was up 86% on Tuesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Nuburu specializes in high-power, high-brightness blue laser systems for industrial applications.

Details of the Acquisition

The acquisition will be completed through Nuburu’s subsidiary, Nuburu Defense LLC, in a two-phase transaction. In the first phase, Nuburu Defense will invest up to $5 million in Orbit over the next three years, beginning with a $1.5 million payment for a 10.7% ownership stake. In the second phase, the company plans to acquire the remaining shares of Orbit by December 31, 2026, at a $12.5 million valuation.

Nuburu Expands Defense Software Footprint with Orbit Deal

The acquisition marks Nuburu’s first move to grow beyond high-performance blue lasers into defense and security offerings.

Notably, Orbit develops software that helps organizations handle crises, maintain operations, and improve resilience across physical and digital systems. Its technology is gaining importance among NATO and defense agencies focused on digital transformation and mission readiness. As a result, the acquisition positions Nuburu to enter the $3 billion global operational resilience market serving NATO, U.S., and EU defense sectors.

Additionally, the deal will make Nuburu’s Defense & Security Hub stronger by bringing together its hardware and software expertise. With global rights to sell Orbit’s platform, Nuburu can now offer complete tools for crisis management and operational resilience. It also creates new ways for the company to earn steady revenue through software subscriptions.

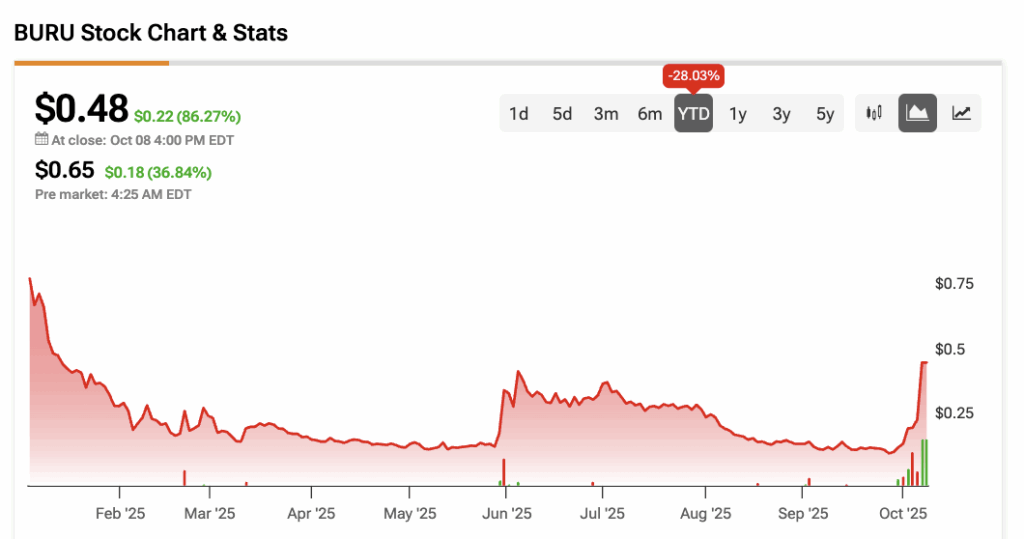

Nuburu’s Stock Performance

Over the past 12 months, Nuburu’s stock has fallen by more than 50%, trading within a 52-week range of $0.12 to $1.60.

So far this year, BURU shares are down about 29%.