Shares of the specialty retailer of hard-surface flooring, LL Flooring (NYSE:LL), are up more than 32% in a month on news of a takeover bid. Further, LL stock gained over 3% in after-hours trade as a consortium of investors, having a significant stake in the company, is pushing the company to engage in the sale process.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Last month, the company confirmed that it had received an offer from Cabinets To Go, LLC, a subsidiary of F9 Brands. Cabinets To Go plans to acquire LL Flooring at a price of $5.76 per share.

Despite receiving the offer, the company didn’t make any moves. At the same time, its management highlighted that LL Flooring is well-positioned for the future and will likely benefit from increased spending on repairs and renovations over the medium to long term.

Investors Push the Board to Engage in the Sale Process

In a letter dated June 13, Howard Jonas, leading a consortium of investors, urged LL Flooring’s management to consider the offer made by F9. Mr. Jonas encouraged the management to engage with the F9 and start a sale process. It’s worth noting that the consortium maintains an economic interest in more than 5% of the company’s outstanding shares.

The letter highlighted that LL Flooring lagged its peers and underperformed over the past several years. This has resulted in a significant level of negative operating cash flow and inventory buildup. Emphasizing the company’s disappointing Q1 performance, Mr. Jonas said, “LL Flooring’s record of underperformance suggests that failing to sell now could threaten further value erosion for stockholders.”

Operational challenges, pressure from brand awareness, and macro headwinds weighed on the company’s Q1 financial performance. Its top line declined by 13.7%, while comparable sales fell by 15.4%. Its SG&A as a percentage of net sales increased by 650 basis points to 42.0%, which is alarming. Meanwhile, the company delivered an adjusted loss of $0.31 a share in Q1.

What’s the Prediction for LL Flooring Stock?

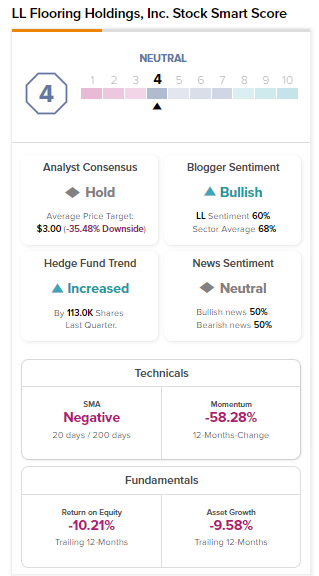

While LL Flooring stock has gained over 32% in one month, it has declined by about 58% in one year due to macro headwinds and weak financial performance. Nonetheless, hedge funds acquired 113K shares of LL Flooring in the past quarter. Further, LL stock has a Neutral Smart Score of four.