Largo Resources (LGO) stock plummeted on Wednesday after the vanadium and ilmenite supplier announced details of a registered direct offering. The company has reached securities purchase agreements with institutional and accredited investors to sell 14,262,309 shares of LGO. These shares will be sold for $1.22 each, bringing the total value of the registered direct offering to $17.4 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition to that offering, Largo Resources also announced connected warrants. This covers unregistered warrants that can be exchanged for up to 14,262,309 shares of LGO. These warrants have an exercise price of $1.22 per share and will expire five years from issuance. They are also immediately exercisable.

To go along with this news, Largo Resources revealed a private placement with Arias Resource Capital Fund III L.P., an affiliate of its largest shareholder. It will provide the company with $6 million in financing and has agreed to acquire 4,918,033 LGO shares and 4,918,033 warrants. This commitment can be advanced via a $5 million loan, which the company expects to use to fund operations through 2026.

Largo Resources Stock Movement Today

Largo Resources stock was down 53.57% in pre-market trading on Wednesday, following a 2.44% rally yesterday. Even so, the shares have rallied 46.51% year-to-date and 27.92% over the past 12 months. Today’s drop makes sense as the registered direct offering and private placement dilute current shareholders’ stakes. The share sale price was also well below the stock’s prior closing price of $2.52.

Is Largo Resources Stock a Buy, Sell, or Hold?

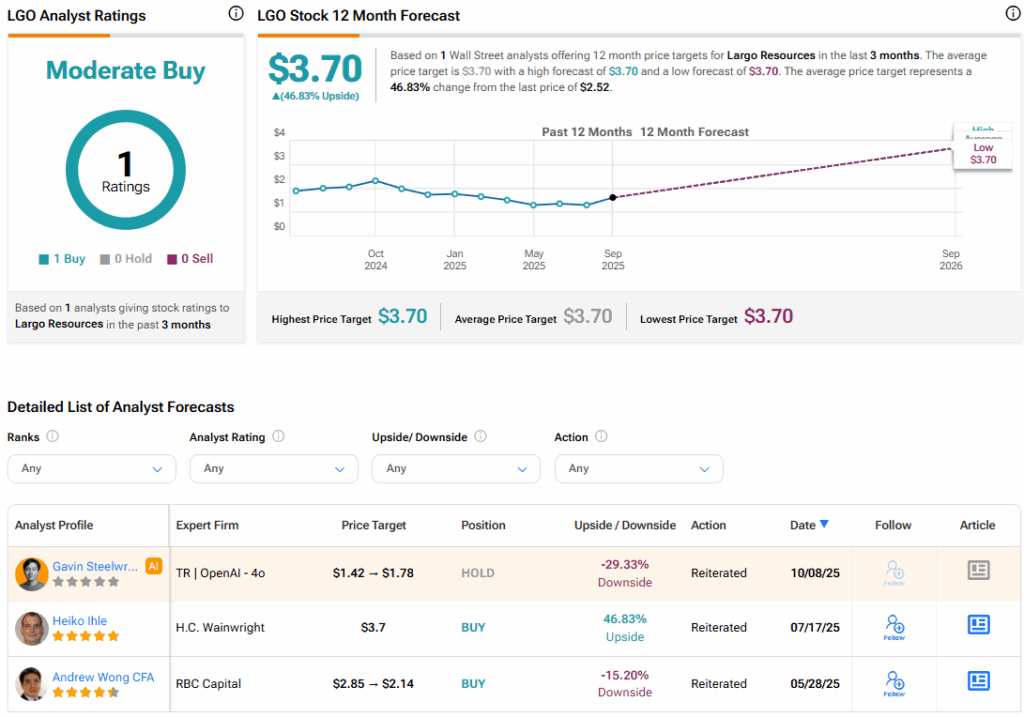

Turning to Wall Street, the analysts’ consensus rating for Largo Resources is Moderate Buy, based on a single Buy rating over the past three months. With that comes an LGO stock price target of $3.70, representing a potential 46.83% upside for the shares.