Joby Aviation (JOBY) shares slipped in pre-market trading today after the electric air-taxi company priced its underwritten public offering of 30.5 million shares at $16.85 each, raising roughly $513.9 million in gross proceeds. The underwriter also received a 30-day option to buy up to 4.6 million additional shares.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Company Raises $513.9 Million to Fund Expansion

The company said the funds will be used for aircraft certification, manufacturing, and preparations for commercial service. The offering is expected to close on October 9, 2025, subject to standard conditions.

Although the deal strengthens Joby’s cash position, investors reacted negatively to the share dilution from the large stock sale. The new shares increase the total number of outstanding shares, reducing the value of existing holdings in the short term.

Joby Stock Performance

The stock is down more than 10% in today’s pre-market trading, following a 4% decline on Tuesday. However, Joby shares have jumped more than 230% over the past year, supported by optimism about the electric air taxi market and the company’s progress toward FAA certification.

Is JOBY a Good Stock to Buy?

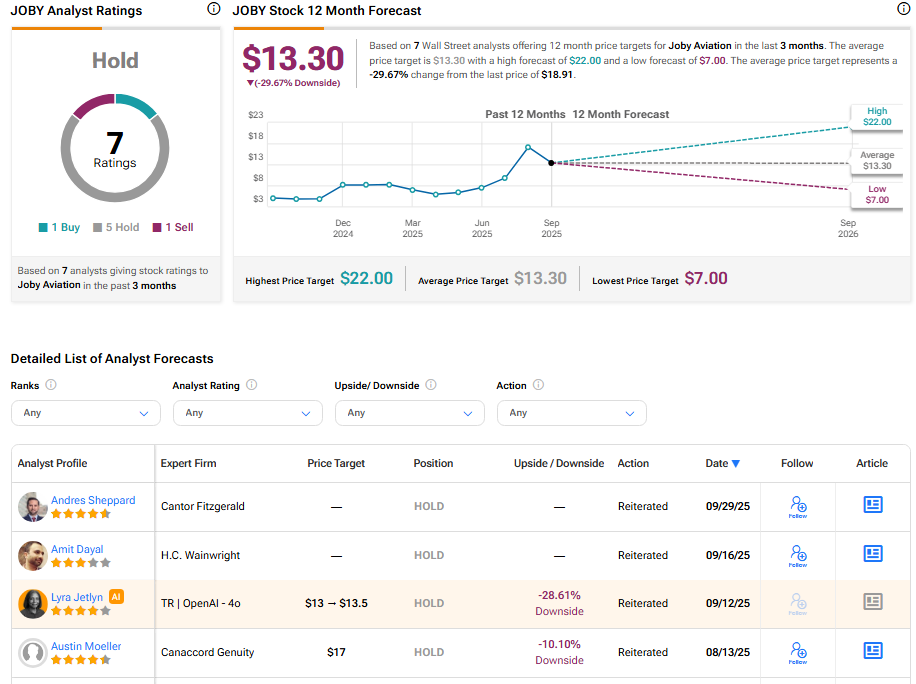

On TipRanks, JOBY stock has received a Hold rating based on one Buy, five Hold, and one Sell recommendations. The average JOBY stock price target is $13.30, implying a 29.67% downside from the current price.