Evoke Pharma (EVOK) stock rocketed higher on Tuesday after the specialty pharmaceutical company announced an acquisition deal with privately held pharmaceutical company QOL Medical. This agreement will have QOL Medical acquire Evoke Pharma for $11 per share, representing a 139.7% premium to the stock’s closing price on Monday. The company will use cash on hand to fund the deal, which it expects to close in Q4 2025.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

QOL Medical wants to acquire Evoke Pharma for its GIMOTI nasal spray. This is the first and only nasal spray formulation of metoclopramide approved by the U.S. Food and Drug Administration (FDA) for the treatment of acute and recurrent diabetic gastroparesis in adults. This is a common condition of diabetes that affects more than 50% of patients. It causes the stomach to empty food into the small intestine slowly or abnormally.

Derick Cooper, CEO of QOL Medical, said, “With our deep experience in commercializing treatments for GI disorders, this acquisition is a natural extension of our capabilities and commitment. It enables us to build on our existing infrastructure, expand our reach among patients and healthcare providers, and further establish QOL Medical as a leader in specialty gastrointestinal care.”

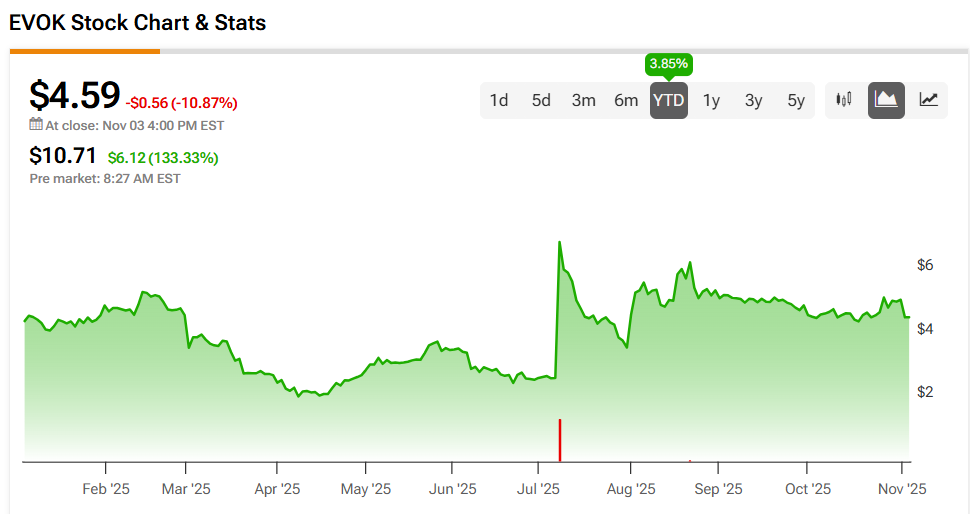

Evoke Pharma Stock Movement Today

Evoke Pharma stock was up 133.33% in pre-market trading on Tuesday, following a 10.87% drop yesterday. The shares have rallied 3.86% year-to-date but are still down 20.73% over the past 12 months.

Today’s news brought heavy trading of EVOK stock, as some 2.1 million shares changed hands, compared to a three-month daily average of about 29,000 units.

Is Evoke Pharma Stock a Buy, Sell, or Hold?

Turning to Wall Street, coverage of Evoke Pharma is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates EVOK stock a Neutral (46) with no price target. It cites “financial difficulties despite notable revenue growth” as reasons for this stance.