Eledon Pharmaceuticals (ELDN) stock plummeted on Friday after the clinical-stage biotechnology company announced results from a Phase 2 clinical trial. This trial was dedicated to testing the effectiveness of tegoprubart for the prevention of organ rejection in patients receiving a de novo kidney transplant.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The big news here is that the study failed to meet its primary endpoint of change in eGFR at 12 months post-transplant. However, the study did report positive results from its efficacy failure composite endpoint. This has encouraged the company to pursue a Phase 3 clinical trial of tegoprubart, despite its failure to achieve statistical significance in the study’s primary endpoint.

Andrew Adams, a University of Minnesota professor, said, “The Phase 2 results presented at ASN Kidney Week highlight the potential of tegoprubart to deliver strong graft function after kidney transplantation, while avoiding the long-term toxicities often associated with current standard of care. It’s been more than a decade since we’ve seen true innovation in transplant immunosuppression. These data offer real hope that patients may soon have a transformative therapy that improves their health outcomes and overall quality of life.”

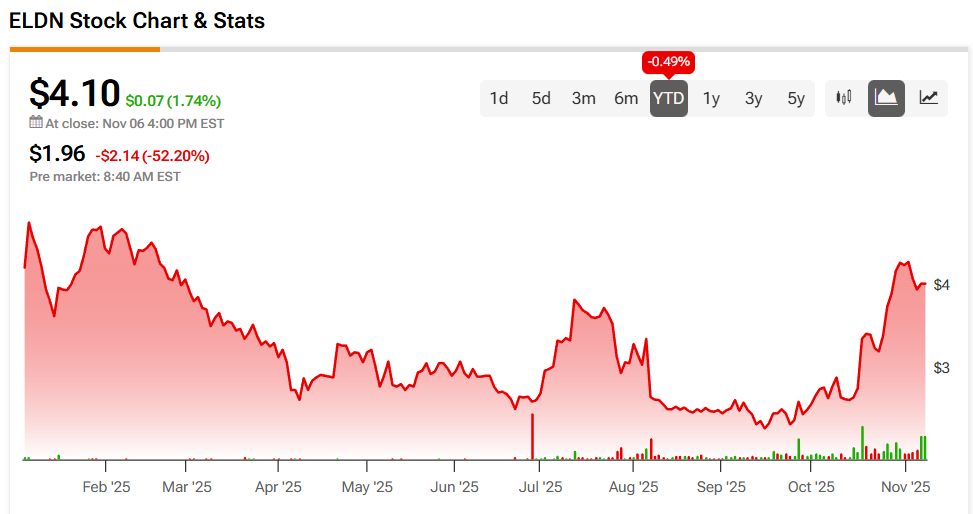

Eledon Pharmaceuticals Stock Movement Today

Eledon Pharmaceuticals stock was down 52.2% in pre-market trading on Friday, following a 1.74% rally yesterday. The shares have slipped 0.49% year-to-date and dropped 15.11% over the past 12 months.

Today’s news brought with it heavy trading of ELDN stock, as some 1.8 million shares changed hands, compared to a three-month daily average of about 1.55 million units.

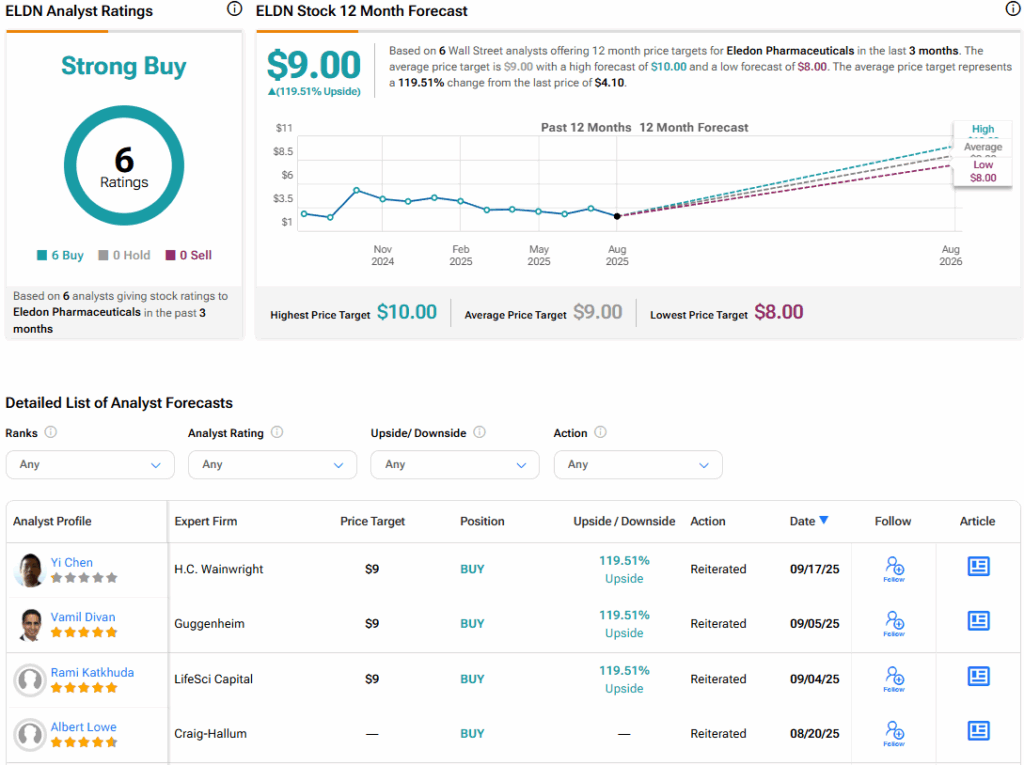

Is Eledon Pharmaceuticals Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Eledon Pharmaceuticals is Strong Buy, based on six Buy ratings over the past three months. With that comes an average ELDN stock price target of $9, representing a potential 119.51% upside for the shares.