Critical Metals (CRML) stock surged more than 80% on Monday as of this writing after a Reuters report said the Trump administration is in talks to take an equity stake in the company. The move would support U.S. efforts to secure domestic access to rare earth materials used in defense and clean energy technologies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The talks reportedly involve the company’s flagship Tanbreez project in Greenland, one of the world’s largest rare earth deposits. Critical Metals last year agreed to buy Tanbreez for $5 million in cash and $211 million in stock, and recently increased its ownership in the project to 92.5% from 42%.

Possible Government Investment Adds to Momentum

The report comes as the Trump administration ramps up its push to strengthen the nation’s critical minerals supply chain. The government has already taken stakes in Lithium Americas (LAC) and MP Materials (MP), both key players in rare earth production.

According to reports, the U.S. government is in early talks to convert Critical Metals’ $50 million Defense Production Act grant application into an equity investment of about 8%. While discussions are still preliminary, such a move would mark a major vote of confidence in the company’s role within the rare earth supply chain.

The potential investment would be separate from a $120 million U.S. Export-Import Bank loan currently under review to help fund Tanbreez’s $290 million development plan.

Is Critical Metals Stock a Buy, Sell, or Hold?

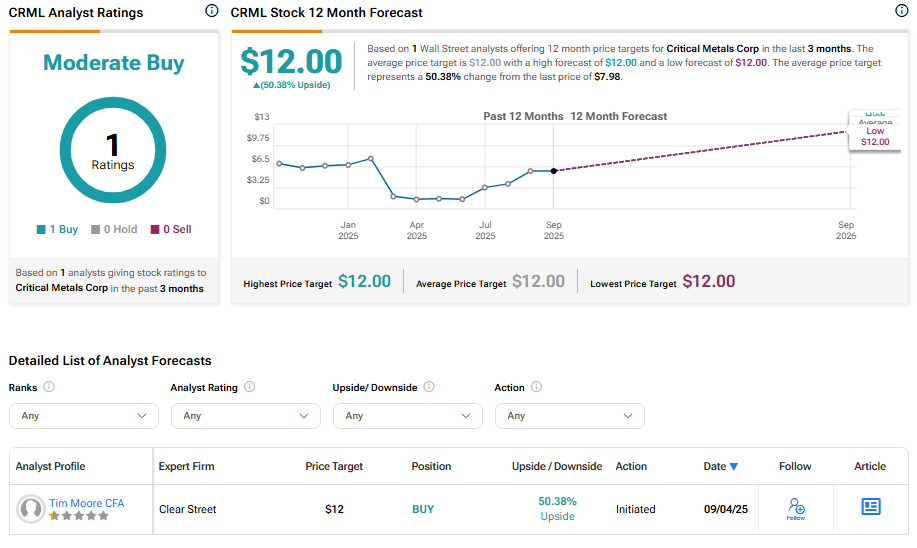

On TipRanks, Critical Metals stock has received a Moderate Buy rating based on coverage from a single Wall Street analyst. Clear Street analyst Tim Moore has a Buy rating on the stock with a price target of $12, implying about 50% upside from the current level of $7.98.