CleanCore (ZONE) stock plummeted on Monday, and the company has released a statement about the drop. According to a press release, the company doesn’t typically comment on volatile price movements. However, it has done so today, as the movement happened without any undisclosed material developments that would explain it, according to the company.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Instead, CleanCore noted that outside factors appear to be behind today’s ZONE stock movement. Among these factors are recent drops in cryptocurrency markets and tightening liquidity across digital asset markets. The company said it will continue to monitor market conditions and will evaluate strategic opportunities to enhance shareholder value.

Clayton Adams, CEO of CleanCore, said, “If ZONE continues to trade at these levels, we will consider implementing a share repurchase program to take advantage of potentially accretive returns to shareholders. This would provide us with the flexibility to adapt and monetize changing market conditions.”

CleanCore Stock Movement Today

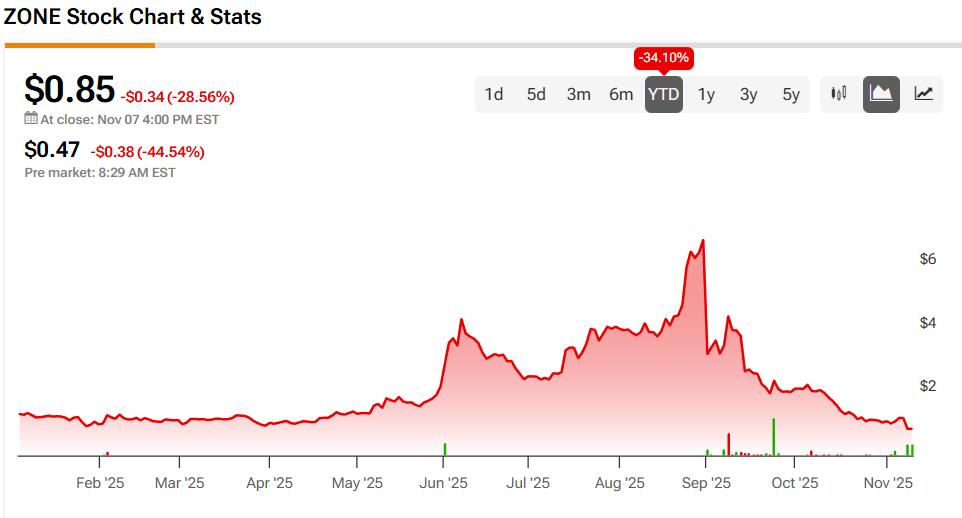

CleanCore stock was down 44.54% in pre-market trading on Monday, following a 28.56% drop on Friday. The shares have also decreased 34.1% year-to-date and 53.8% over the past 12 months.

Investors will note that today’s volatile stock price came with heavy trading of ZONE shares. This had more than 6.3 million shares traded as of this writing, compared to a three-month daily average of about 1.88 million units. The stock also saw heavy trading on Friday, when some 10.03 million shares changed hands.

Is CleanCore Stock a Buy, Sell, or Hold?

Turning to Wall Street, analyst coverage of CleanCore is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates ZONE stock an Underperform (39) with a $1 price target. It cites “significant financial challenges, including negative profitability and cash flow issues” as reasons for this stance.