Chijet Motor (CJET) stock rocketed higher on Wednesday after the new energy vehicle company announced a massive investment for its digital asset treasury strategy. The company has signed a Memorandum of Understanding with certain institutional investors for a private placement of $1 billion that will be used to transform Chijet Motor into a digital asset holding company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Chijet Motor noted that the $1 billion commitment is a 50-fold increase over what it expected from a private placement from institutional investors. With these funds, the company will focus on its digital currency, which includes “the development of advanced infrastructure for secure digital asset custody and innovative storage solutions.”

Chijet Motor CEO Melissa Chen said, “This extraordinary vote of confidence from our investors validates our strategic vision and execution capability. The 50-fold expansion of committed capital provides us with significant financial flexibility to develop secure crypto custody infrastructure and pursue strategic acquisitions in the rapidly growing digital asset storage ecosystem.”

Chijet Motor Stock Movement Today

Chijet Motor stock rocketed 124.06% in pre-market trading on Wednesday, following a 4.65% drop yesterday. The shares have fallen 93.01% year-to-date and 91.69% over the past 12 months. With today’s private placement news came heavy trading of CJET stock. This saw some 221 million shares traded this morning, compared to a three-month daily average of about 76.35 million units.

Is Chijet Motor Stock a Buy, Sell, or Hold?

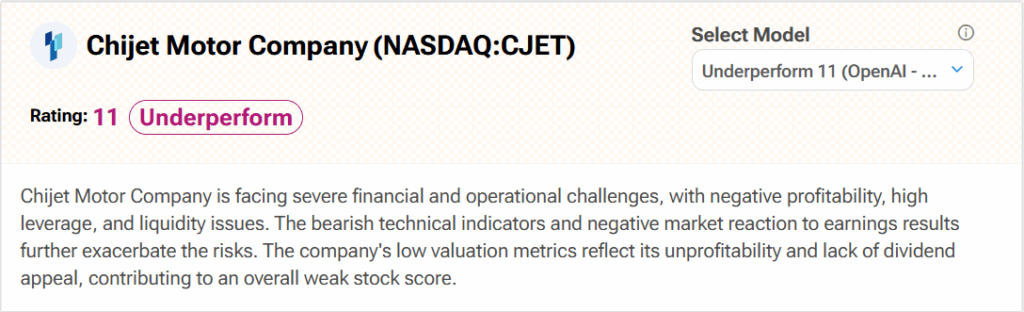

Turning to Wall Street, analysts’ coverage of Chijet Motor is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates CJET stock an Underperform (17) with no price target. It cites “severe financial and operational challenges, with negative profitability, high leverage, and liquidity issues” as reasons for this stance.