Cathie Wood’s ARK Invest boosted its position in Bullish (BLSH) on Monday, purchasing about 238,000 shares worth roughly $12 million across its flagship funds, according to the firm’s daily trade filings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The ARK Innovation ETF (ARKK) acquired 164,214 shares, while the ARK Next Generation Internet ETF (ARKW) and the ARK Fintech Innovation ETF (ARKF) bought 49,056 and 25,076 shares, respectively. The move follows last week’s purchases totaling more than $5 million and builds on ARK’s earlier investment of roughly $172 million at Bullish’s $1.1 billion NYSE debut.

Bullish Records Strong Demand after Options Platform Launch

ARK’s latest round of buying came just as Bullish reported $82 million in trading volume within five days of launching its new crypto options platform. The product allows clients to use their entire portfolio as collateral across spot, futures, and options markets. This is a model designed to boost capital efficiency and attract professional traders.

Institutional partners including FalconX Global, Wintermute, and BlockTech participated in the launch. “We’ve built a product that aims to resolve the pain points that exist today in trading crypto options,” Bullish said on X.

The platform’s fast start appears to have caught the market’s attention, with options trading adding a new revenue stream to Bullish’s existing spot and futures businesses.

Regulatory Progress Strengthens U.S. Presence

Bullish has also expanded its U.S. footprint, officially launching in 20 states last month after securing its BitLicense and money transmission license from the New York State Department of Financial Services. Those approvals marked a key milestone for the exchange, which aims to deepen its presence in regulated markets.

The firm began U.S. operations with two institutional clients, BitGo and Nonco, and has already processed more than $1.5 trillion in global trading volume since its founding in 2021. It now ranks among the top 10 exchanges by Bitcoin and Ethereum activity.

Bullish Shares Edge Lower Despite Institutional Support

Despite the surge in trading activity and ARK’s continued buying, Bullish shares closed down 0.7% on Monday at $50.26, slipping slightly to $50.02 after hours. The modest decline came amid broader market softness in crypto-related equities.

Still, Cathie Wood’s steady accumulation suggests long-term confidence in Bullish’s growth strategy and in the growing overlap between institutional trading and on-chain finance.

Is Bullish Stock a Good Buy?

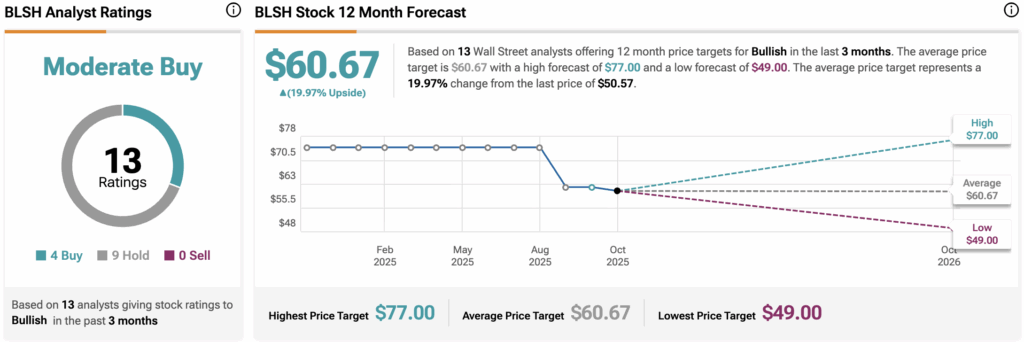

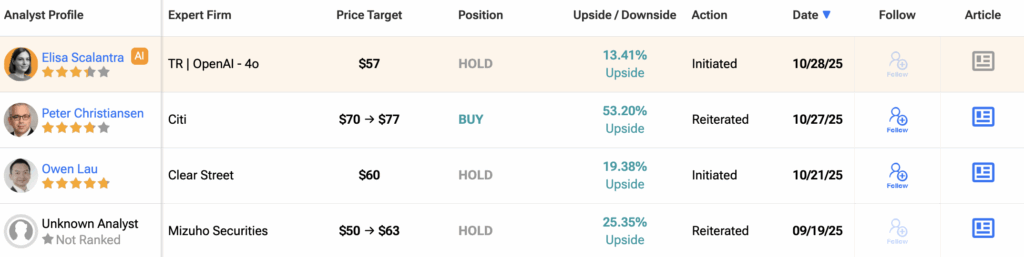

Based on ratings from 13 Wall Street analysts over the past three months, Bullish (BLSH) holds a “Moderate Buy” consensus. Of the analysts surveyed, four rate the stock a Buy and nine suggest Hold, with no Sell ratings issued.

The average 12-month price target for Bullish is $60.67, implying a potential 19.97% upside from the recent share price.