BIO-key International (BKYI) stock took off on Friday after the biometric identification and authentication solutions company announced a significant new deployment. The company reached this agreement with a major defense-sector security organization in the Middle East. The customer requested that their identity not be revealed for security reasons.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With this deal, BIO-key International will provide the organization with support for its critical infrastructure and sensitive access environments. The company noted that this is one of its largest contracts in the region, and expands its footprint. It attributed this deal to its strategic partnership with Saudi-based value-added distributor Cloud Distribution.

Alex Rocha, Managing Director International at BIO-key International, said, “Our Identity-Bound Biometric solutions are designed to deliver the highest levels of assurance without adding operational complexity. This project reflects the trust placed in BIO-key’s technology to secure the most sensitive environments, and we are honoured to collaborate with Cloud Distribution to make it a reality.”

BIO-key International Stock Movement Today

BIO-key International stock was up 53.95% in pre-market trading on Friday, following a 5.86% drop yesterday. The shares have fallen 62.88% year-to-date and decreased 45.28% over the past 12 months.

Today’s news came with heavy trading for BKYI stock, as some 72 million shares changed hands. To put that in perspective, the company’s three-month daily average trading volume is about 125,000 units.

Is BIO-key International Stock a Buy, Sell, or Hold?

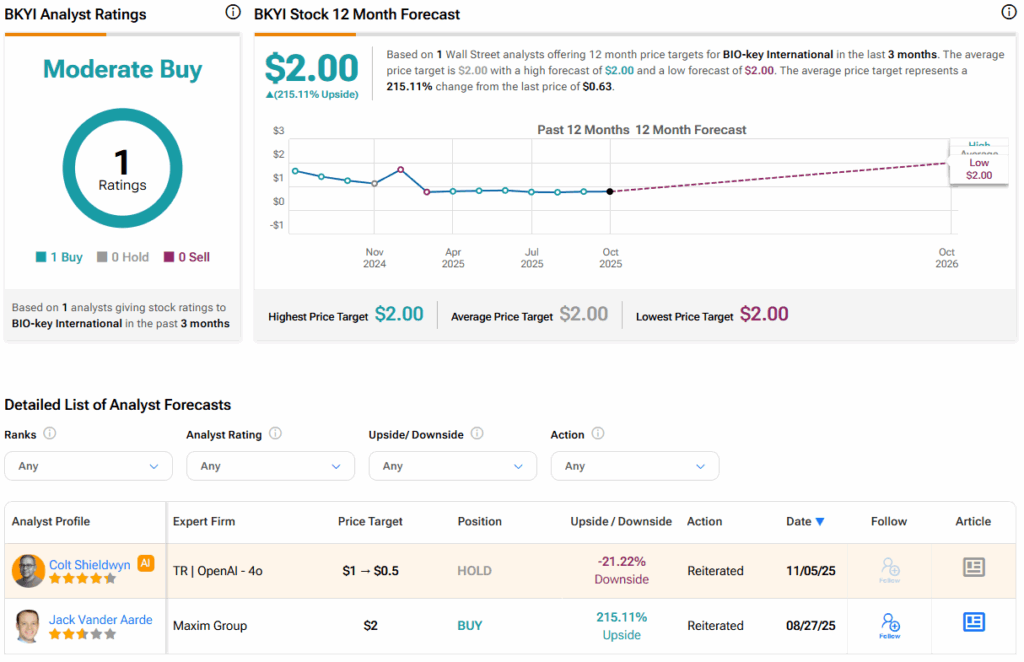

Turning to Wall Street, the analysts’ consensus rating for BIO-key International is Moderate Buy, based on a single Buy rating over the past three months. With that comes an average BKYI stock price target of $2, representing a potential 215.11% upside for the shares.