Airwa (YYAI) stock rocketed higher on Wednesday alongside insider buying following its change from Connexa Sports Technologies. Director Michael Belfiore purchased 3,213,095 shares of YYAI stock, which represents a 22.1% stake in the sports-technology–turned–crypto-asset company. Airwa is specifically focused on holding Solana (SOL-USD) tokens.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to a filing with the Securities and Exchange Commission (SEC), Belfiore made his YYAI stock purchase for investment reasons. The director believes in the potential of Airwa and its new strategy. His stock purchases were made on October 7 and October 8, right after the company changed its name.

Airwa Stock Movement Today

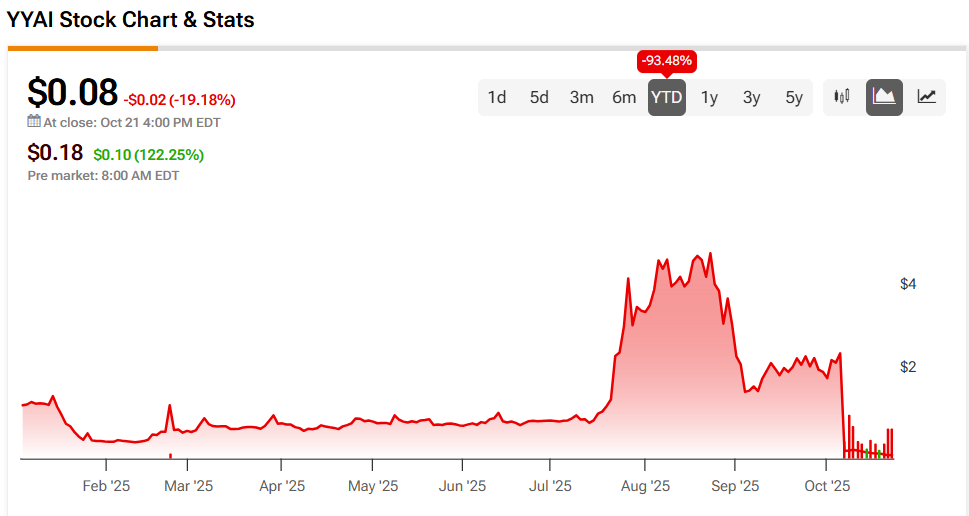

Airwa stock was up 122.25% in pre-market trading on Wednesday, following a 19.18% fall yesterday. The stock has decreased 93.48% year-to-date and 98.31% over the past 12 months. With today’s news came heavy trading, as some 461 million shares changed hands, compared to a three-month daily average of about 153 million units.

Insider trading can be a massive benefit to a company’s stock, as it shows leaders are confident in the shares. This can raise investor morale, resulting in more stock purchases. That helps explain some of Airwa’s stock movement today. However, the company’s penny stock price means speculative traders could also be using the insider trading news to pump and dump the shares.

Is Airwa Stock a Buy, Sell, or Hold?

Turning to Wall Street, analyst coverage of Airwa is lacking. Fortunately, TipRanks AI analyst Spark has it covered. Spark rates YYAI stock an Underperform (25) with no price target. It cites “financial and operational challenges,” including “declining revenues, negative profitability, and high liabilities” as reasons for this stance.