HUB24 (ASX:HUB) shares rose as much as 15% by midday, after the Australian investment platform provider announced its latest net inflow figures.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

HUB24 offers an array of financial and investment products targeting individual clients and corporate customers. The company’s platforms delivered net inflows of AU$3 billion for the first quarter FY23. Although that’s down 1.6% from a year earlier, it’s considered strong given the changed market environment. HUB24 now has a total of AU$68.4 billion funds under administration (FUA).

HUB24 has also announced the pilot launch of its HUB24 SMSF Access, which targets financial advisors that are seeking cost-effective solutions for their clients.

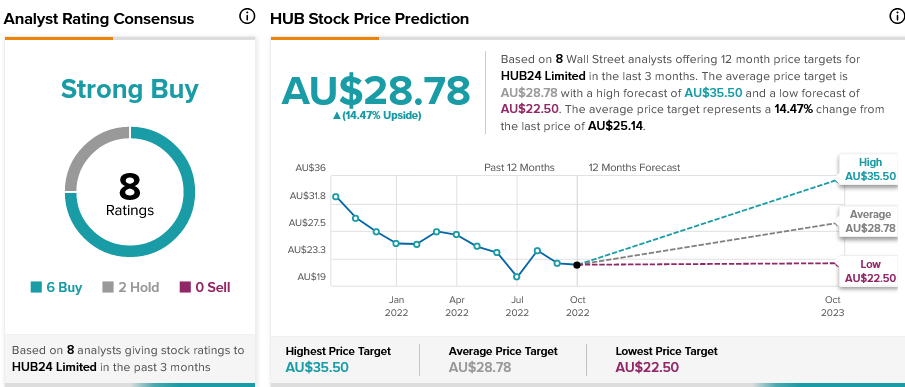

HUB24 share price forecast

According to TipRanks’ analyst rating consensus, HUB stock is a Strong Buy based on six Buys and two Holds. The average HUB24 share price forecast of AU$28.78 indicates over 14% upside potential.

HUB24 scores an eight out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.