Billion-dollar chipmaker Qualcomm (QCOM) has found itself in hot water with Chinese regulators, casting a serious shadow over its growth prospects. Just two weeks ago, China’s State Administration for Market Regulation (SAMR) revealed it had opened an antitrust investigation into the company. The probe focuses on Qualcomm’s acquisition of Israeli auto-tech firm Autotalks, a deal finalized in June 2025 after the company reportedly told regulators it was abandoning the transaction—a move that now appears to have drawn scrutiny.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Adding to the turbulence, reports of notable insider selling in October have only deepened investor unease. While Qualcomm still fits the mold of a growth stock, the geopolitical and regulatory overhang makes it a risky bet for now. Given the growing uncertainty, I’m taking a neutral stance and maintaining a Hold rating on Qualcomm.

Qualcomm Caught in a Geopolitical Crossfire

Qualcomm’s business model is a geopolitical paradox. It stands as a crown jewel of U.S. technology, responsible for designing the wireless patents and chips that underpin much of the global smartphone ecosystem. Yet, the company’s fortunes are deeply intertwined with America’s chief economic rival. In fiscal 2024, 46% of Qualcomm’s total revenue came from China (including Hong Kong)—a dependency that’s hard to overlook.

That reliance puts Qualcomm in an exceptionally precarious position. As the U.S.–China trade conflict intensifies—with Washington threatening new tariffs and Beijing responding with export restrictions on critical materials—Qualcomm risks becoming a prime target for geopolitical retaliation.

China has already shown its willingness to single out U.S. semiconductor firms, most notably through its 2023 ban on Micron’s (MU) products in sensitive data center infrastructure—a move that sent shockwaves through the chip sector. For Qualcomm, whose business is nearly half-exposed to China, any meaningful regulatory action, supply chain disruption, or sales restriction could deliver a serious blow to earnings and investor confidence.

A Mature Business Desperate for Growth

Qualcomm’s geopolitical exposure is made even more precarious by the growth slowdown in its core business. The global smartphone market has reached maturity, with upgrades rather than new users driving demand. While handsets still generate the bulk of revenue for Qualcomm’s largest segment—QCT (Qualcomm CDMA Technologies)—accounting for over 70% of total sales last quarter, that core is increasingly under siege.

Yes, quarterly sales rose 10% year-over-year in the most recent quarter, but the company’s longer-term growth trajectory remains weak. Qualcomm’s three-year compound annual growth rate (CAGR) has slipped to just 0.9%, signaling stagnation.

Moreover, competition is fierce: MediaTek surpassed Qualcomm as the world’s top mobile System-on-a-Chip (SoC) supplier by volume, while key partners are steadily moving away. Apple (AAPL) is phasing out Qualcomm’s cellular modems in favor of its own, and Samsung is expanding use of its Exynos processors across more devices.

With its core handset business plateauing, diversification isn’t just strategic—it’s existential. Qualcomm has smartly turned toward Automotive and the Internet of Things (IoT) as new growth pillars. The automotive division has been particularly promising, growing 44% year-to-date in fiscal 2025. Still, it remains small, contributing only 8.8% of total revenue. That’s precisely what made the Autotalks acquisition—a key bet on connected vehicle technology—so critical, and why China’s antitrust probe now poses such a serious threat to Qualcomm’s long-term diversification plans.

How Bad Could the China Probe Be?

The new antitrust probe strikes at the core of Qualcomm’s future growth strategy. Autotalks, the Israeli firm at the center of the controversy, specializes in V2X (vehicle-to-everything) communication—a foundational technology for smart and autonomous vehicles. China, fiercely protective of its rapidly expanding electric vehicle (EV) sector, may be wary of Qualcomm integrating this technology into its global patent portfolio, potentially undermining domestic competitors.

Qualcomm knows all too well how powerful Chinese regulators can be. In 2018, Beijing effectively torpedoed its planned $44 billion acquisition of NXP Semiconductors (NXPI) by dragging out the approval process until it expired—forcing Qualcomm to abandon the deal and eat a $2 billion termination fee. Having learned from that experience, management appears to have taken a bold risk this time: Qualcomm quietly completed the Autotalks acquisition after signaling to regulators that it had walked away. China’s State Administration for Market Regulation (SAMR) has now confirmed that sequence of events, suggesting the company’s gamble may have backfired. The potential fallout could be severe.

Potential Penalties

Under China’s anti-monopoly law, penalties can reach up to 10% of a company’s prior-year revenue in the market under scrutiny. Based on Qualcomm’s $17.8 billion in 2024 China sales, that could translate into a multi-billion-dollar fine. When Qualcomm was fined $975 million in 2015, regulators showed some leniency—but this time, the optics are worse. SAMR may see Qualcomm as a repeat offender trying to outmaneuver oversight, increasing the likelihood of a harsher outcome.

Even if financial penalties are modest, the strategic risk is enormous. Regulators could impose restrictions on Qualcomm’s V2X licensing, force Chinese rivals to pay below-market prices for access to the tech, or even limit the integration of the tech into vehicles sold in China. Any of these measures could cripple Qualcomm’s automotive ambitions, just as the company begins leaning on that business for growth.

Adding another layer of unease are recent insider stock sales. CEO Cristiano Amon offloaded nearly $25 million in Qualcomm shares during October, while the CFO has been a consistent seller since January. Insider sales don’t always imply trouble—they’re often part of pre-arranged trading plans or personal diversification moves—but the timing and magnitude of the CEO’s transactions are likely to draw investor scrutiny amid mounting regulatory headwinds.

Valuation: Reasonable Price, Unreasonable Risk

From a valuation standpoint, Qualcomm is attractive at first glance. The stock trades at a forward P/E of 14.2x, well below the sector median of 25.1, implying a discount to peers. Its forward EV/EBITDA multiple of 11—which measures the company’s total enterprise value relative to its operating earnings—also reinforces the appearance of a reasonably priced stock.

However, the growth picture tells a different story. Qualcomm’s forward PEG ratio sits at 2.6, well above the fair-value benchmark of 1.0 and the sector median of 1.8. This indicates that, despite its modest earnings multiples, the stock may actually be overvalued relative to its sluggish earnings growth outlook. In short, Qualcomm looks cheap on the surface, but when growth (or the lack of it) is factored in, the valuation becomes far less compelling.

Is QCOM a Good Buy Now?

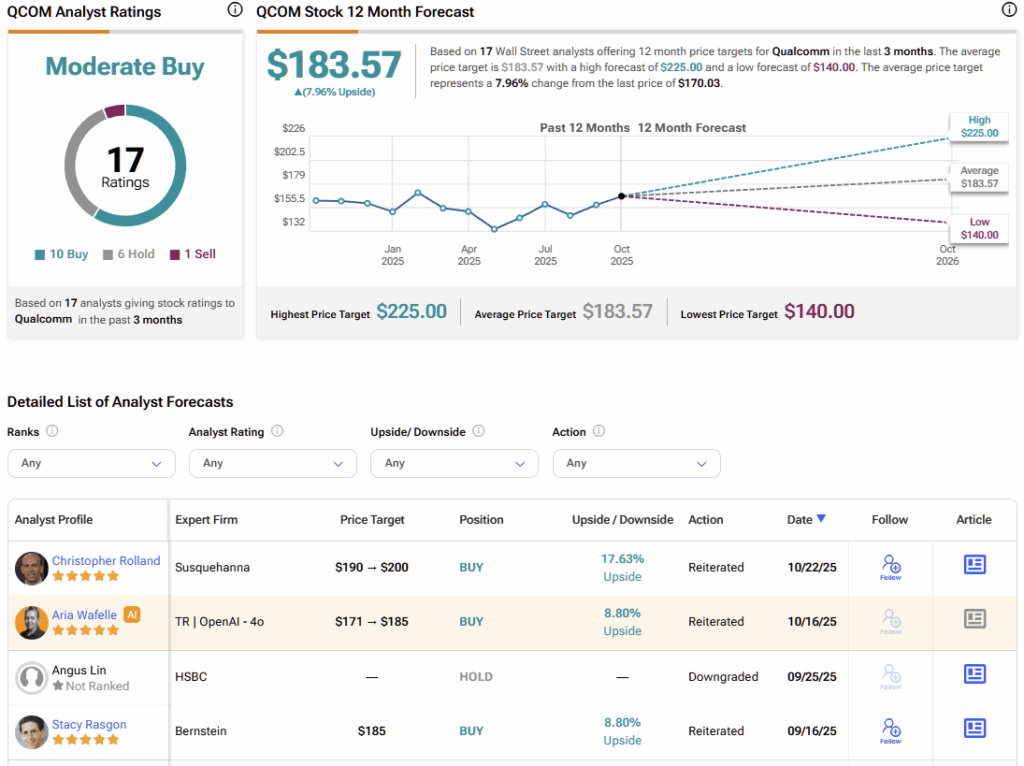

On Wall Street, QCOM stock carries a Moderate Buy consensus rating based on ten Buy, six Hold, and one Sell rating over the past three months. QCOM’s average stock price target of $183.57 implies almost 8% upside potential over the next twelve months.

Holding Onto Qualcomm Stock

Qualcomm remains a world-class technology leader—but one now trapped in a complex global crossfire. Its appealing P/E ratio and low enterprise value multiples mask deeper concerns: slowing growth, mounting competition, and legal risks that are impossible to quantify. The company is battling on multiple fronts—technological, competitive, and geopolitical—all at once.

The new Chinese antitrust probe strikes directly at Qualcomm’s most promising growth engine in automotive and connected technologies. Given the company’s fraught history with Chinese regulators, the uncertain timeline and potential severity of penalties, and the recent wave of insider stock sales, the cloud of uncertainty hanging over QCOM could easily intensify into a full-blown storm.

Until there’s clarity on the investigation’s outcome and the scope of regulatory risk, maintaining a Hold rating on Qualcomm stock appears to be the most prudent course of action.