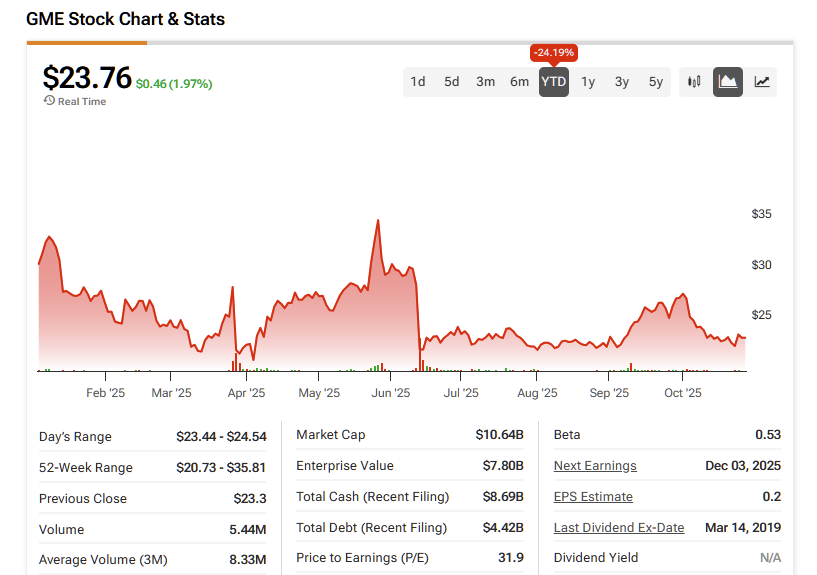

Shares of the video game retailer had a brief glimmer of hope when GameStop (GME) reported its fiscal Q2 results in September, with the stock jumping as much as 17% by early October. However, throughout the month, that momentum quickly faded, and today GameStop trades roughly at the same levels as before the July-quarter release—marking a sharp ~24% year-to-date decline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Under CEO Ryan Cohen, GameStop has undeniably pulled off a balance-sheet miracle. During the wild meme rallies, the company took advantage of its inflated valuation by raising cash through equity issuances (and yes, diluting shareholders). Now, it’s doing the same through convertible notes—still dilutive, but not right away. At the same time, it seems to have found a way to run its core gaming retail business roughly at breakeven.

Although GameStop bought about half a billion dollars’ worth of Bitcoin (BTC) a few months ago, it’s been nearly five months without any new purchases, raising questions about what exactly the company plans to do with its massive cash pile.

Until that question is answered, the value thesis can’t quite evolve beyond the meme narrative—which continues to dominate sentiment and drag on the stock. For now, I’m staying neutral on the name, and a Hold rating still feels like the most reasonable stance.

A Financial Rebound, Not Yet a Turnaround

To better understand what drove GameStop’s recent re-rating between September and October, it’s worth noting that, oddly enough, the primary catalyst came from the income statement.

After seven consecutive quarters of shrinking revenue—some of them in double digits—the company finally delivered 21.8% year-over-year growth, reaching $972.2 million in sales and posting its highest quarterly net profit in years at $168.6 million. It was GameStop’s fifth straight profitable quarter, even surpassing the $131.3 million earned in fiscal Q4, the holiday season, typically its strongest period.

The key growth drivers were hardware and collectibles, contributing $592.1 million and $227.6 million in revenue, up 31.2% and 63.3% year over year, respectively. Those gains were fueled by tailwinds from the new console cycle (like the Switch 2) and the booming trading-card market.

GameStop’s newfound “consistency” in profitability isn’t coming from pricing power, but rather from aggressive SG&A (selling, general, and admin. expenses) cuts and a meaningful boost in interest income on its now roughly $9 billion cash pile. In fiscal Q2, the company reported $218 million in SG&A, likely its lowest in decades, totaling $973 million over the last twelve months—alongside a hefty $245 million in interest and investment gains alone.

GameStop Trimmed the Fat and Hoarded the Cash

Despite CEO Ryan Cohen and the GameStop management team maintaining an opaque tone and offering very little clarity about their strategy—the company doesn’t even host earnings calls—it’s quite clear that the plan is to make GameStop profitable and as asset-light as possible. Since Cohen took over as CEO, the company has shut down operations in several European countries, including Ireland, Germany, and Italy, as well as its Canadian subsidiary.

To put that into perspective, since 2020, GameStop’s net property, plant, and equipment has fallen from $1 billion to just $302.2 million. Yet, paradoxically for a brick-and-mortar retailer, its total assets have grown from $2.4 billion in 2021 to an impressive $10.3 billion—thanks entirely to its massive cash position.

Speaking of cash, if GameStop once raised funds through equity issuance—taking advantage of its super-hyped “meme” valuation—it’s now doing so through leverage. In fiscal Q2, the company increased its long-term debt by $4.1 billion through two convertible-note offerings (with conversion prices of $29.85 and $28.91 per share). This allows GameStop to boost its cash balance without immediate dilution.

Additionally, GameStop announced the distribution of 59 million warrants to shareholders as a “special dividend”, giving them the right to purchase a common share at $32 until the end of October 2026. If fully exercised, the company expects to raise up to $1.9 billion in gross proceeds from the issuance.

Pouring Cash into Bitcoin

What has left market participants scratching their heads is that, in theory, according to GameStop’s own filings, the company intended to use the proceeds from its convertible notes for general corporate purposes—including the purchase of Bitcoin. Yet the video game retailer is still holding the same 4,710 Bitcoin it bought between May 3 and May 28, worth $500 million at the time and now valued at $528.6 million.

While some argue that GameStop is imitating MicroStrategy’s (MSTR) playbook—raising capital through convertible instruments and light leverage—the company led by Ryan Cohen hasn’t taken the next step of becoming a true Bitcoin “proxy” like Strategy, which keeps adding to its holdings almost every month. In other words, I don’t think GameStop’s management is confident enough to reconfigure its business model around Bitcoin. Rather, it seems to be using the cryptocurrency more as a hedge or as part of a “modernization” narrative.

These uncertainties, in my view, have prevented GameStop’s stock from sustaining its momentum. It’s clear that Cohen’s mission is to move the company beyond the meme era, and with nearly $9 billion in cash, the thesis has indeed matured—but only to a point.

So much so that, if we accept that GameStop’s investment case has evolved into a “balance sheet story”, the most appropriate way to value it is through an asset-based approach. Over the last twelve months, GameStop’s price-to-book ratio has averaged around 2x, roughly 10% below the retail sector average. This suggests that, under this lens, the once “surreal” meme-style valuations no longer apply. Meanwhile, GME’s P/E ratio of 30x is higher than the sector average of 20x.

The problem, however, is that markets price in the future—and for now, the only thing that can realistically be projected is that GameStop will keep growing its cash pile, not much else. That makes a truly fundamental bullish thesis hard to sustain.

Is GME a Buy, Hold, or Sell?

Over the past month, GameStop stock has been rated mostly as a Hold by analysts covering the name. Out of seven ratings, six are Hold and one is Sell, with no price targets currently disclosed in the consensus.

Beyond the Meme, But Not Beyond Doubt

I believe GameStop has made real progress toward becoming a genuine “balance sheet story”, showing signs of maturity that could eventually move it beyond its meme-stock status. However, the company still needs to provide more clarity on how it plans to monetize its massive cash pile, as the current uncertainty makes the thesis hard to justify from a fundamental value standpoint. For now, I continue to view GameStop as a Hold, since its potential upside remains highly unpredictable given today’s circumstances.