Beaten by the production issues in China resulting from Beijing’s strict anti-COVID measures, global tech giant Apple (AAPL) has told some of its contract manufacturers that it wants to increasingly seek production outside China, according to a WSJ report.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Among the next best contenders, the world’s largest information technology company by revenue, is considering other Southeast Asian countries like India and Vietnam as a possible manufacturing hub.

Notably, the iPhone maker already has its production sites in both countries, which, just like China, also have a high-population advantage and a low-cost benefit.

Why the Shift?

According to the Wall Street journal, a host of problems in China, including lockdowns in Shanghai and the resulting supply challenges, have threatened Apple’s production.

Furthermore, Beijing refrained from criticizing Russia for its invasion of Ukraine, which has left the global community disappointed.

In April, the company warned that the resurgence of COVID-19 could negatively impact sales to the tune of $8 billion in the current quarter.

According to analysts, over 90% of Apple products, including iPhones, iPads, and MacBook laptops, have their manufacturing base in China.

The reason for the strong dependence on China is driven by a number of key benefits that include the lower cost of production in China versus the U.S., a robust network of suppliers for main parts, and an exemplary skilled workforce.

However, many big corporations’ production has been severely hit by the lockdowns in Shanghai and other cities as part of China’s anti-COVID policy.

In fact, this is not the first time that Apple has made an effort to reduce its dependence on China. Even before the COVID-10 pandemic broke in early 2020, the company expressed its plans to build manufacturing capabilities outside China.

Wall Street’s Take

On May 20, Wedbush analyst Daniel Ives reiterated a Buy rating on Apple, with a price target of $200 (36.84% upside potential).

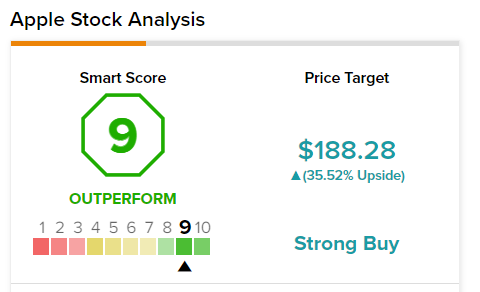

Overall, the stock has a Strong Buy consensus rating based on 21 Buys and six Holds. The average Apple price target of $188.28 implies 36.84% upside potential from current levels.

TipRanks’ Smart Score

Apple scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has a strong potential to outperform market expectations.

Concluding Thoughts

As a result of Beijing’s indirect support for the Russian invasion of Ukraine and lockdowns in some cities to control the COVID-19 resurgence, production for many big multinational corporations (MNCs) is in the doldrums.

Shifting base away from the world’s manufacturing hub, China, is a gigantic move indeed. Will the other global stalwarts like Apple follow in its footsteps? Only time will tell.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Why Are Top Insiders Selling Meta Stock?

Why Did Sea Shares Jump 14%?

Home Depot Hits Home Run with Solid Q1 Results