CoreWeave (CRWV), an AI (artificial intelligence) infrastructure provider, has seen its stock rally about 200% over the past month, fueled by solid guidance and a major deal with OpenAI. Despite robust AI tailwinds, Wall Street analysts have mixed views on CoreWeave stock, with many seeing downside risk from current levels due to several reasons, including elevated valuation, high debt levels, and profitability concerns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts Are Divided on CoreWeave Stock

CoreWeave impressed investors with a 420% surge in its Q1 2025 revenue to about $982 million, reflecting strong demand for the company’s GPU-powered infrastructure for AI workloads. While many analysts acknowledge CoreWeave’s solid prospects amid the generative AI wave, they are concerned about the company’s high interest payments on debt that was taken to support its expansion. Some have even pointed out CRWV stock’s lofty valuation.

On Tuesday, Moffett Nathanson analyst Nick Del Deo reiterated a Hold rating on CRWV stock while increasing the price target to $56 from $43. Deo stated that while he raised the price target, he is “not inclined to simply chase the shares higher.” In fact, the analyst sees downside risk compared to his balanced outlook when he initiated coverage of CoreWeave stock. Deo thinks that management might try to capitalize on the jump in the stock price by issuing convertible securities or by buying hard assets with equity. “We don’t think investors should touch this stock either way,” cautioned Deo.

Further, Barclays analyst Raimo Lenschow downgraded CoreWeave stock to Hold from Buy but raised the price target to $100 from $70. The 5-star analyst contends that while the company’s growth remains impressive, the stock is already trading at a “healthy premium” compared to its peers. Lenschow continues to appreciate CoreWeave’s long-term growth opportunity and exposure to the generative AI wave. That said, he sees limited upside potential over the near term for CRWV stock due to its steep valuation and lack of near-term catalysts.

Meanwhile, Stifel analyst Ruben Roy, who initiated coverage of CoreWeave stock with a Buy rating last month, noted that it is a leading provider of GPU-as-a-service, with infrastructure specifically designed for AI applications. Despite challenges such as debt and depreciation concerns, Roy expects the company’s strategic execution to enable it to gain a significant share in a rapidly expanding market. The 5-star analyst highlighted CRWV’s competitive advantages, including its extensive data center network and partnerships with leading technology providers like Nvidia (NVDA), which has a stake in the company. Despite near-term financial pressures like elevated debt levels related to infrastructure expansion, Roy contends that the long-term outlook for the company looks positive. However, it’s worth noting that Roy’s revised price target of $75 (following the Q1 results) also indicates significant downside for the stock from current levels.

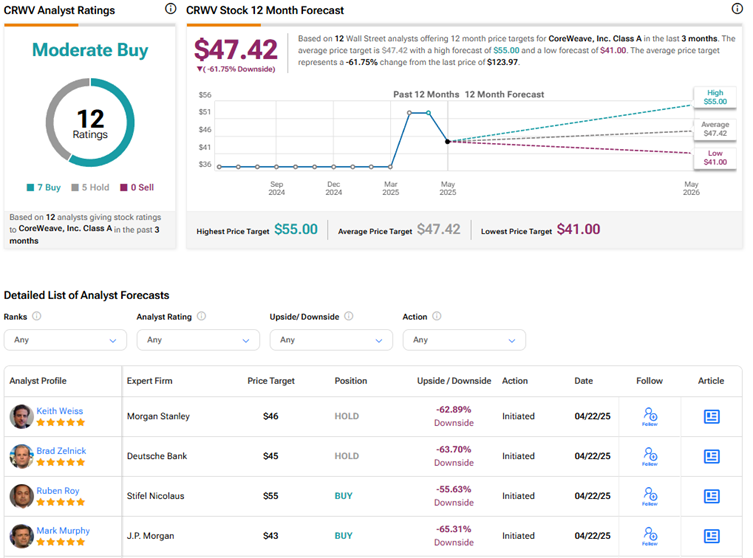

Is CRWV Stock a Buy, Hold, or Sell?

Overall, Wall Street is cautiously optimistic on CoreWeave stock based on seven Buys and five Holds. The average CRWV stock price target of $47.42 implies a downside risk of about 62% from current levels.