Shares of Weber Inc. (NYSE: WEBR) crashed 22.5% yesterday after the grill and barbecue maker jolted the shareholders with management changes and disappointing guidance. To make things worse, the company’s Board has also temporarily halted its quarterly cash common dividend. WEBR stock ended the day down 12.6% at $6.56 on July 25.

In an unexpected announcement, Weber said CEO Chris Scherzinger was leaving the company and the Board. He will be replaced by the current Chief Technology Officer, Alan Matula, as the Interim CEO until a permanent CEO is found. Matula has served in different positions at different organizations and brings along 40 years of experience.

Weber’s Q3 Preliminary Results Fail to Impress

The outdoor cooking company also reported preliminary results for the third quarter ending June 30, 2022, which failed to impress. Weber said it expects net sales to be between $525 million and $530 million, reflecting both a stark sequential and year-over-year decline.

The company’s sales were hurt by overall sluggish retail traffic, both in-store and online, stemming from the global inflationary crisis, supply chain challenges, and geopolitical tensions. Additionally, constant foreign currency devaluations also hurt its reported results.

Furthermore, Weber’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) are expected to be marginally profitable. The company also projects a net loss for the quarter driven by currency devaluations, higher promotional expenses, a lower margin country, product mix, and freight cost increases.

To beat these issues, Weber is planning to undertake several cost-saving initiatives, including employee layoffs; tightening its global inventory levels and capital expenditures; as well as lowering other manufacturing and administrative expenses.

Due to the above uncertainties, Weber has withdrawn its full-year fiscal 2022 net sales and adjusted EBITDA guidance provided earlier. The company will provide a further update when it releases its Q3 results on August 15.

Analysts Are Cautious about WEBR

Following the news, Bank of America analyst Robert Ohmes downgraded WEBR stock to a Sell rating from Hold while also slashing the price target to $5 (23.8% downside potential) from $9.

With six Holds and one Sell, WEBR stock has a Hold consensus rating. The average Weber price target of $7.25 implies 10.5% upside potential to current levels. Meanwhile, the stock has lost 46.4% so far this year.

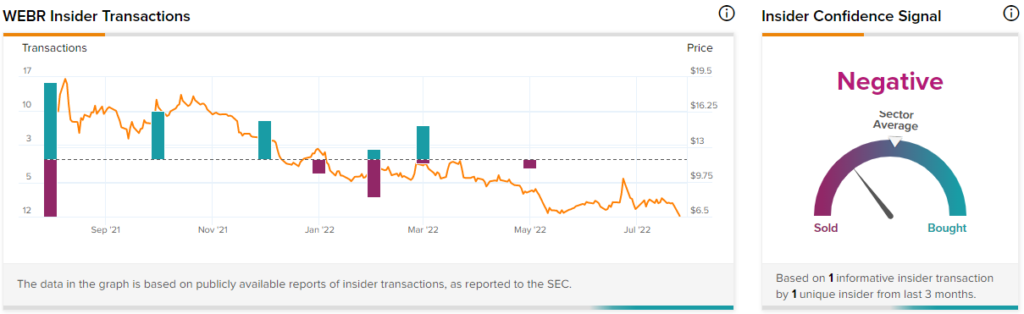

Insider Sentiment is Negative

TipRanks’ Insider Trading Activity shows that Insider Signal is currently Negative on Weber, with corporate insiders selling $386,000 shares in the last quarter. It seems that the insiders who have the most information about the actual state of the company suspect that there is trouble brewing inside.

Parting Thoughts

The pandemic-triggered stay-at-home mandates had boosted Weber’s sales. Now that people have started venturing out, there is a lower demand for Weber’s grills and barbecue equipment. Additionally, the current macroeconomic headwinds further suppress both sales and margins at the retailer. Several CEOs are exiting companies since they are unable to steer through difficult times. Hopefully, Weber can successfully undertake the cost-saving initiatives and emerge a winner when the worst is behind us.