Shares of high-performance power systems manufacturer Vicor (VICR) jumped over 7% on Thursday morning after accelerating by 30.33% on Wednesday. Both moves came after the company reported its third-quarter fiscal year 2025 results, exceeding Wall Street expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Vicor’s revenue climbed 18.5% to $110.4 million, compared to the same period last year, trumping analysts’ predictions of $95.4 million. In addition, the company’s earnings per share rose year over year to $0.63, up from 26 cents.

CEO Patrizio Vinciarelli attributed the performance to record-breaking revenue generated from the company’s licensing business. Vicor, which licenses its power systems to Original Equipment Manufacturers (OEMs) and hyperscalers, expects this revenue to grow substantially in subsequent quarters.

Vicor’s technology could be deployed by OEMs such as Tesla (TSLA) for its electric vehicle power systems, Apple (AAPL) for its high-performance computing, and Nvidia (NVDA) for its data center and AI hardware.

Vicor’s Sequential Revenue and Margins Recede

However, on a quarter-on-quarter basis, Vicor’s revenue declined nearly 22%, as a one-time patent litigation settlement had boosted its revenue in the prior quarter. Another area of weakness was its gross profit margin, which dipped by 780 basis points to 57.5% in Q3.

Going forward, Vinciarelli noted that Vicor will ramp up its effort to stop contract manufacturers from building computing systems that use its patented technology without authorization. The company also intends to go after electronics part suppliers that work hand-in-hand with these manufacturers.

Is Vicor a Good Stock to Buy?

Meanwhile, TipRanks’ data shows that Vicor’s shares currently have limited coverage on Wall Street. VICR stock currently holds a Hold consensus rating based on two Hold ratings issued on Wednesday, reflecting roughly a 3% downside.

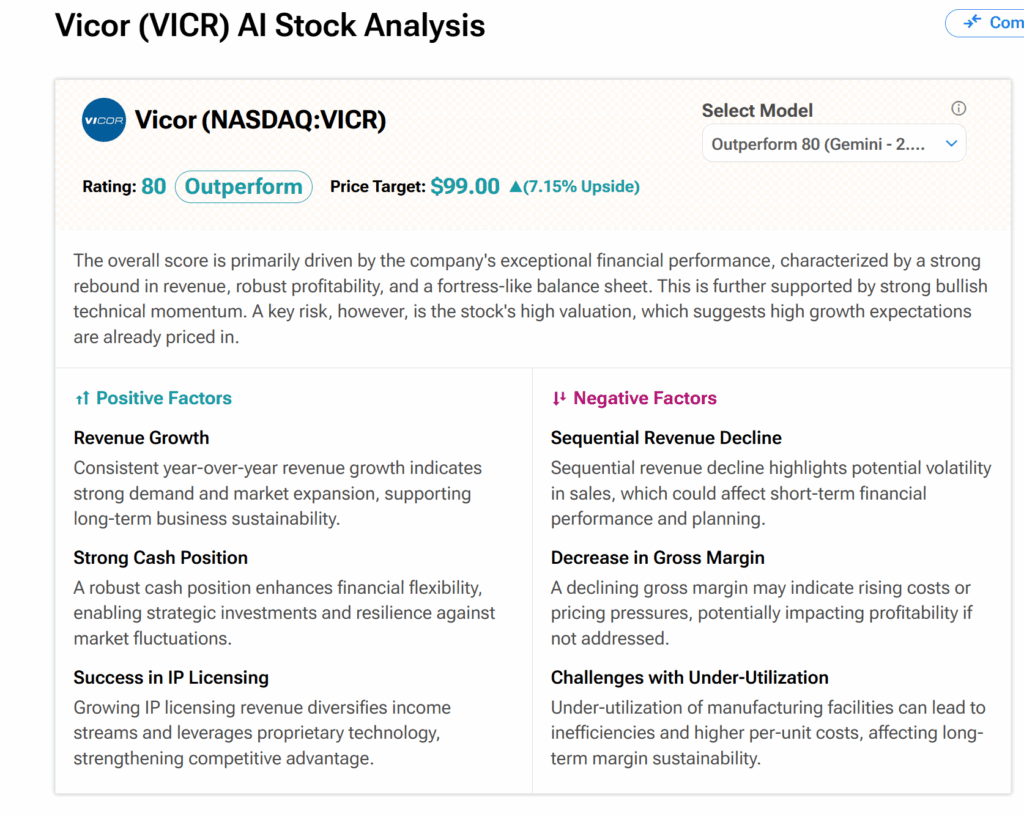

However, TipRanks’ AI stock analyst Spark’s $99 price target implies about 7% upside potential. This is based on the Gemini model’s Outperform grade and a score of 80 out of 100.