Shares of The New York Times Company (NYSE: NYT) jumped nearly 12% yesterday after activist investor ValueAct disclosed a 6.7% stake in the American mass media company. NYT stock ended the day gaining 10.6% at $35.05 on August 11.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As per a regulatory filing, ValueAct Master Fund bought 11,014,741 shares of The New York Times, representing a 6.7% stake in the company. The shares were bought over multiple transactions in the period from June 13, 2022, to August 11, 2022, with prices ranging between $28.76 to $32.10.

What Does ValueAct Propose for NYT?

As per a Bloomberg report, ValueAct wants the media house to push further into subscriber-only bundles to improve its margins. The activist hedge fund has full faith in NYT’s ability to emerge stronger in the current environment. They suggest that NYT should take advantage of the “generational shift” and focus on its subscriber-only digital products, including the Athletic, crosswords and games, cooking, and news.

Furthermore, it believes that NYT is currently undervalued and that the management has several opportunities to beat the macroeconomic headwinds that face the industry.

ValueAct said in a letter to investors on Thursday, “Our research suggests that most current readers and subscribers are interested in the bundle and would pay a large premium for it but are not aware the offering even exists.”

Moreover, ValueAct believes that these steps will help “to accelerate growth, deepen NYT’s competitive moat, and ensure the long-term strength and stability of the platform.”

Meanwhile, the management at The New York Times is aware of ValueAct’s build-up of stakes in the company. The company said that they have had numerous conversations with ValueAct to understand their viewpoints and will continue to make decisions that are in the best interest of all stakeholders.

Recently, NYT reported solid second-quarter results, beating both revenue and earnings estimates. The company’s adjusted earnings of $0.24 per share beat the consensus by $0.05 per share. Similarly, the revenue of $555.68 million beat the consensus by $1.94 million.

Notably, the company added 180,000 net digital-only subscribers and 230,000 digital-only subscriptions compared to Q1FY22.

Is NYT a Good Stock to Buy?

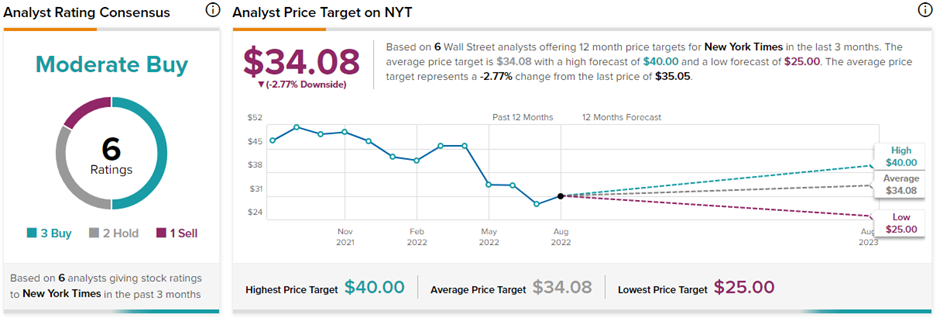

On TipRanks, NYT stock has a Moderate Buy consensus rating based on three Buys, two Holds, and one Sell. The average New York Times Company price target of $34.08 implies 2.8% downside potential to current levels. Meanwhile, the stock has lost 26.8% so far this year.

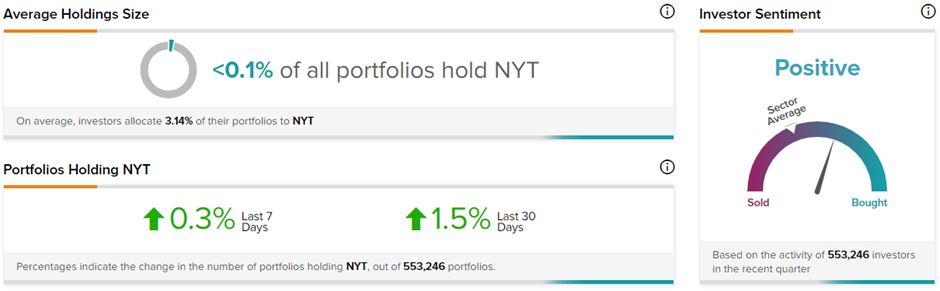

On the other hand, retail investors are also optimistic about NYT stock. TipRanks’ Stock Investors tool shows that investor sentiment is currently Positive on The New York Times Company, with 1.5% of portfolios tracked by TipRanks increasing their exposure to NYT stock over the past 30 days.

Notably, the company also pays a quarterly cash common dividend of $0.09 per share, representing a current dividend yield of 1.04%.

Ending Thoughts

ValueAct’s interest in the New York Times Company seems to have sparked a fire at the media house. Hopefully, the activist investor will push the company in the right direction and turn it into an accelerated long-term growth trajectory. Meanwhile, NYT is already proving worthwhile as a digital media house in times of shifting consumer preferences online. And investors seem to grab the stock at the current lows to take advantage of its long-term growth potential.