Shares of Dick’s Sporting Goods (NYSE: DKS) had a rather turbulent day. Its stock reached a new all-time low of $63.45 after the company lowered guidance, and then gained more than 14% as investors sought relief in DKS exceeding first quarter expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

DKS is an American omni-channel sporting goods retailer offering authentic sports equipment, apparel, footwear, and accessories. DKS stock finally ended the day up 9.7% at $78.14 on May 25.

Lauren Hobart, President and CEO of DKS, said, “Over the past two years, we have demonstrated our ability to adeptly manage through the pandemic and other challenges – and we are confident in our continued ability to adapt quickly and execute through uncertain macroeconomic conditions. DICK’S has a unique and powerful position in the marketplace, and we remain confident in our strategies and our ability to deliver long-term sales and earnings growth.”

Q1FY22 Results in Detail

Dick’s reported adjusted earnings of $2.85 per share, 32 cents higher than Street estimates but much lower than the comparative quarter’s figure of $3.79 per share.

Similarly, net sales of $2.7 billion fell 7.5% year-over-year but beat consensus estimates by $70 million.

Moreover, comparable store sales declined 8.4% compared to the same period last year, which had recorded a 117.1% jump.

The company’s Board also authorized a quarterly cash common dividend of $0.4875 per share on its common stock and Class B Common stock to be payable on June 24, to shareholders of record on June 10. The current dividend yield stands at 9.6%.

Dick’s Lowers 2022 Outlook

Based on the current uncertain macroeconomic environment, Dick’s has lowered its full-year fiscal 2022 sales guidance.

The company expects comparable store sales to fall by 2% to 8% year-over-year. As a result, its adjusted earnings are projected to be lower and to fall between $9.15 per share and $11.70 per share (previous forecast was between $11.70 per and $13.10 per share). Meanwhile, consensus estimates are pegged much higher at $12.55 per share.

Analysts’ Take

Responding to Dick’s “better-than-feared” Q1 results and lowering of guidance, Robert W. Baird analyst Justin Kleber lowered the price target on DKS stock to $85 (8.8% upside potential) while maintaining a Hold recommendation.

Although markets reacted positively to DKS results even though the company cut its FY22 forecast, Kleber maintains a cautious outlook owing to macroeconomic pressures on discretionary spending.

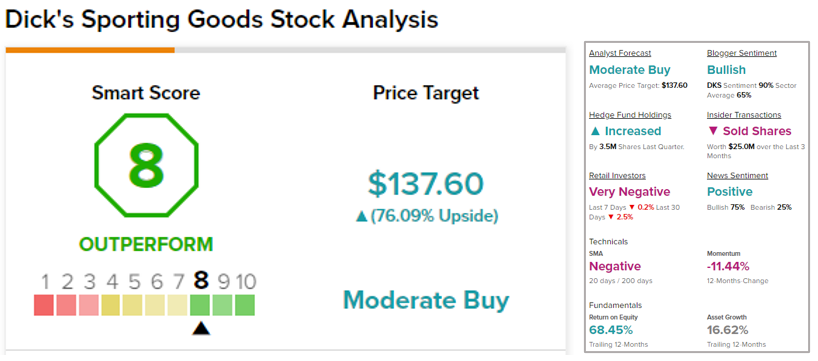

Other analysts on the Street also have a cautiously optimistic view of the stock, with a Moderate Buy consensus rating based on ten Buys and five Holds. The average Dick’s Sporting Goods price target of $137.60 implies 76.1% upside potential to current levels.

Stock Analysis

According to TipRanks’ Smart Score, Dick’s Sporting Goods earns an eight, indicating that the stock is likely to outperform the market. Bloggers and news articles are bullish on the stock, and hedge funds have increased their holdings of DKS stock by 3.5 million shares in the last quarter.

However, corporate insiders have sold shares worth $25 million in the last three months and retail investors have also decreased their holdings by 2.5% in the last 30 days.

Ending Thoughts

Retailers are undoubtedly facing the most difficult times with inflationary pressures and near-term uncertainty dragging down interest in the sector. Even Dick’s investors are giving out mixed signals, as is seen from the various TipRanks tools above. It might be wise to wait on the sidelines until the dust settles.

Read full Disclosure