Scienture (SCNX) stock rallied on Thursday after the holding company for existing and planned pharmaceutical operating companies announced the start of commercial sales and fulfillment of the first customer orders for Arbli. This is the company’s oral liquid formulation of losartan potassium that is more palatable for patients who have trouble taking hard tablets. Losartan potassium is used to treat several conditions, such as high blood pressure, kidney disease, and, heart failure. It can also reduce the risk of a stroke.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Scienture noted that it has launched an outreach program to get Arbli out to more patients. This includes multiple commercial group purchasing organization agreements with healthcare institutions across the U.S. The company said these agreements represent potential penetration into an estimated 20% of the U.S. institutional market.

Narasimhan Mani, President and co-CEO of Scienture, said, “The start of commercial sales for Arbli™ represents a major achievement for Scienture as we transition from development to execution. As promotional efforts expand and demand builds across retail, institutional and long-term care markets, we see significant potential for sustained adoption and value creation.”

Scienture Stock Movement Today

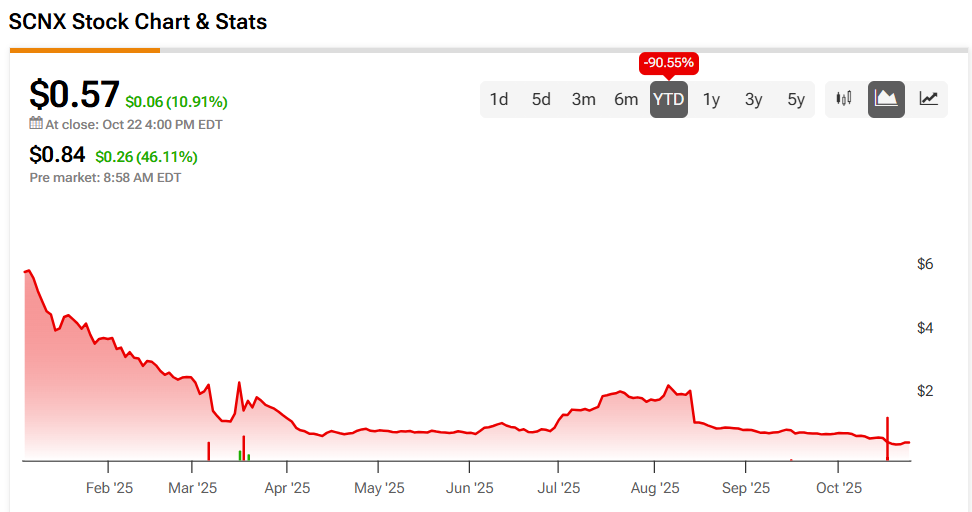

Scienture stock was up 46.11% in pre-market trading on Thursday, extending a 10.91% rally yesterday. Even so, SCNX shares have fallen 90.55% year-to-date and 92.22% over the past 12 months.

With today’s news came heavy trading of Scienture stock. This had more than 77 million shares traded as of this writing, compared to a three-month daily average of about 4.08 million units.

Is Scienture Stock a Buy, Sell, or Hold?

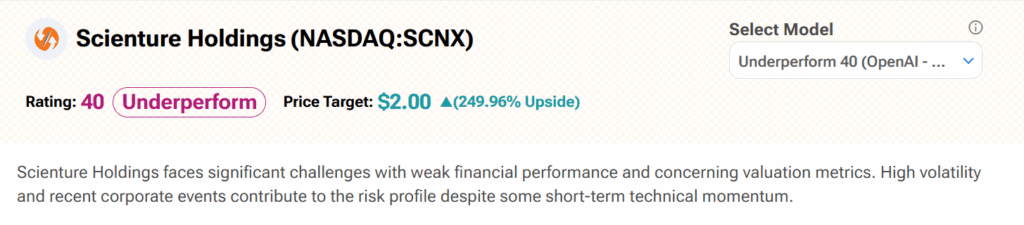

Turning to Wall Street, analyst coverage of Scienture is limited. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates SCNX stock an Underperform (40) with a $2 price target. It cites “weak financial performance and concerning valuation metrics” as reasons for this stance.