Shares of PGT Innovations (NYSE:PGTI) jumped nearly 15% in the after-hours of trading as the company rejected a $1.9 billion buyout offer. Per a Reuters report, Miter Brands, a PGTI rival, offered to acquire the company for $33 a share. The offer reflects a premium of about 26% based on its closing price of $26.20 on October 9. Nonetheless, the manufacturer and supplier of premium windows and doors declined the offer.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Miter Brands, backed by Koch Industries, is considering increasing its offer to $36 per share.

This development follows PGTI’s adoption of a poison pill in March, a measure put in place to diminish the chances of someone gaining control of the company through open market accumulation. The plan aimed at stopping a hostile takeover is set to end on March 30, 2024. It remains uncertain whether Miter Brands will successfully reach an agreement.

Meanwhile, let’s look at what the Street recommends for PGTI stock.

What is the Price Target for PGTI?

PGTI stock has gained nearly 46% year-to-date, despite a challenging macro environment. Meanwhile, analysts’ price targets suggest further upside potential.

The company is benefitting from continued strength in the repair and remodeling division and price increases. Further, investors cheered the company’s productivity and cost control measures, supporting its bottom line.

PGTI’s management expects new construction market activity to recover in the second half of this year, which will support its revenue and earnings growth. However, the macro uncertainty is keeping analysts cautiously optimistic about the stock.

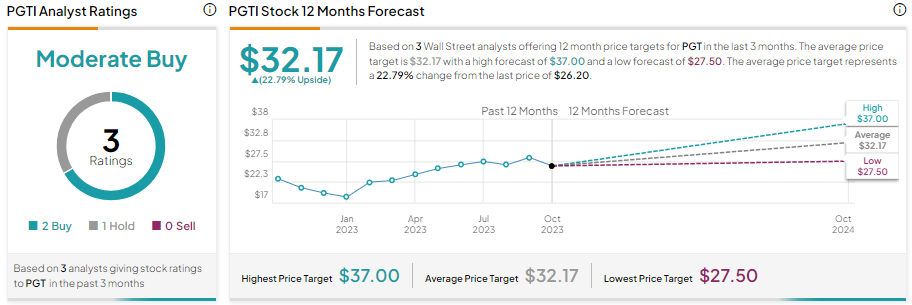

PGTI stock has received two Buy and one Hold recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $32.17 implies 22.79% upside potential from current levels.