Shares of chip maker Micron Technology (NASDAQ:MU) gained 5.5% on March 23, peaking at a month-high price of $61.78. The stock is gaining traction steadily as the company draws closer to its Fiscal 2023 second-quarter results date, set for March 28, 2023, after the market closes.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Street expects Micron to post an adjusted loss of $0.66 per share on revenues of $3.74 billion. The current expectations show a significant decline over Micron’s historical performance. Remarkably, in Q2FY22, Micron posted an adjusted profit of $2.14 per share on revenues of $7.79 billion.

Analysts Expect Weak Results Yet Remain Bullish

Micron is a leader in the dynamic random-access memory (DRAM) and NAND chip markets. The elevated levels of inventories of these chips at both Micron and its customers are forcing the company to write down its inventories. Having said that, analysts are expecting the memory chip market to make a strong comeback by the end of Fiscal 2023.

Recently, Citigroup analyst Christopher Danely reiterated a Buy rating on MU stock with a price target of $75 (22.3% upside potential). Danely believes Micron will report a huge inventory write-down in its Q2 results as well as report negative margins for the first time in over a decade.

Despite the weakness, Danely believes there is only an upward trend going ahead for Micron as the market for its memory chips is bottoming out.

Analyst Mehdi Hosseini of Susquehanna also shares similar insights as Danely. In a recent report, Hosseini cut the FY23 estimates, citing write-down and slowing demand issues.

As per the five-star analyst, the average selling prices (ASP) of both DRAM and NAND chips are showing a significant drop and will remain low this year. Going ahead, however, the shipments are expected to increase, putting Micron back on the map.

Hosseini has a Buy rating on MU stock with a price target of $65, implying nearly 6% upside potential.

Is MU Stock a Buy, Hold, or Sell?

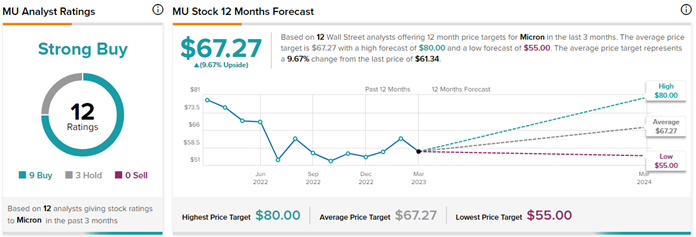

With nine Buys and three Hold ratings, Micron commands a Strong Buy consensus rating on TipRanks. Also, the average Micron Technology price target of $67.27 implies 9.7% upside potential from current levels. Meanwhile, MU stock has gained 21.8% so far this year.