Shares of Marvell Technology (NASDAQ:MRVL), the producer of semiconductors and related technology, dropped 5.2% in after-hours trading despite delivering stronger-than-expected Q2 earnings and benefitting from solid AI (Artificial Intelligence) demand. While demand for AI products continues to grow, the weakening enterprise and storage end markets irked investors, leading to a decline in its share price.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Q2 Results in Detail

Marvell delivered revenue of $1.341 billion in Q2, which came slightly ahead of the Street’s expectations of $1.33 billion. However, its top line declined by 12% year-over-year as revenue from the enterprise on-premise portion of its data center end market decreased significantly, reflecting the weakening enterprise market. Further, the company highlighted that the storage end market demand remains significantly depressed, with customer inventory remaining high. This took a toll on its storage revenues.

Nonetheless, the demand for AI applications is growing rapidly, which is positive. Further, the company benefitted from the acceleration of the cost reduction measures. However, lower year-over-year sales weighed on its profitability.

Marvell Technology delivered earnings of $0.33 per share compared to analysts’ forecast of $0.32 a share. The company’s EPS exceeded analysts’ consensus estimate but declined by $0.57 in the year-ago quarter.

For Q3, the company expects to deliver EPS of $0.40 (+/-$0.05) on revenue of $1.4 billion (+/-5%), indicating that its top and bottom lines could continue to decline year-over-year.

With Marvell’s top and bottom lines projected to decline in Q3, let’s look at what the Wall Street analysts recommend for its stock.

Is Marvell a Good Stock to Buy?

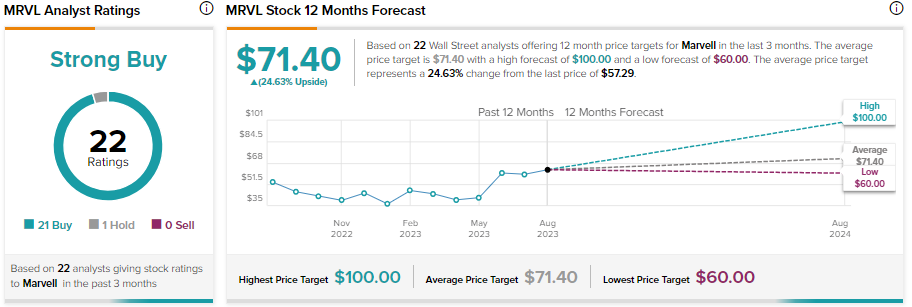

Marvell is expected to benefit from solid AI-led demand, keeping analysts bullish about its prospects. MRVL stock has received 21 Buy and one Hold recommendations for a Strong Buy consensus rating. Meanwhile, analysts’ average price target of $71.40 represents 24.63% upside potential from current levels.

However, investors should note that these ratings and price targets were provided before the Q2 earnings. Given the expected weakness in the enterprise and storage end markets, the analysts’ views and price targets could change. Further, MRVL stock has gained over 55% year-to-date, implying that the positives from AI-led demand are reflected in its price.