Google stock (GOOGL) slipped Tuesday after the tech giant quietly rolled out a powerful new AI tool for film production—without saying much about it. The hush-hush debut has investors scratching their heads, wondering what it means for the search titan’s next big AI play.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Google Tests Filmmaking AI Behind Closed Doors

Google’s new generative AI tool—reportedly called “VideoFX”—has begun circulating in creative circles, allowing users to generate short cinematic videos from text prompts. According to early reports, it’s built on Google’s Gemini model and appears aimed at competing with OpenAI’s Sora.

But here’s the kicker: Google hasn’t publicly announced it. Instead, it’s offering private access to a handful of creators and influencers, potentially to refine the tech before a larger release.

That stealth approach may explain why the stock took a hit. Shares of Alphabet were down slightly in early Tuesday trading, despite broader market gains. Investors seem wary of another “wait and see” rollout at a time when Microsoft (MSFT) and OpenAI are publicly gobbling up AI mindshare.

Alphabet Keeps Playing Catch-Up

While Gemini has powered a string of new products across Google Docs, Gmail, and Android, critics argue that Alphabet’s AI rollout still feels behind the curve. Meta (META) and OpenAI have raced ahead in text and image generation. Now, with Sora dominating headlines for AI video, Google’s under-the-radar launch of VideoFX feels… tentative.

And that might be part of the problem.

As one analyst from Bernstein told CNBC, “If Google wants to lead in AI, they can’t afford to be timid in the one area where hype matters almost as much as the tech.”

Google Stock Sentiment Cools Despite AI Spend

Despite the AI expansion, Google stock has been treading water. Shares are up just 1.5% in the past week, lagging peers like Nvidia (NVDA) and Microsoft. Investors may be waiting for more than just new tools—they want proof that Google can commercialize them fast.

Is Google a Good Buy?

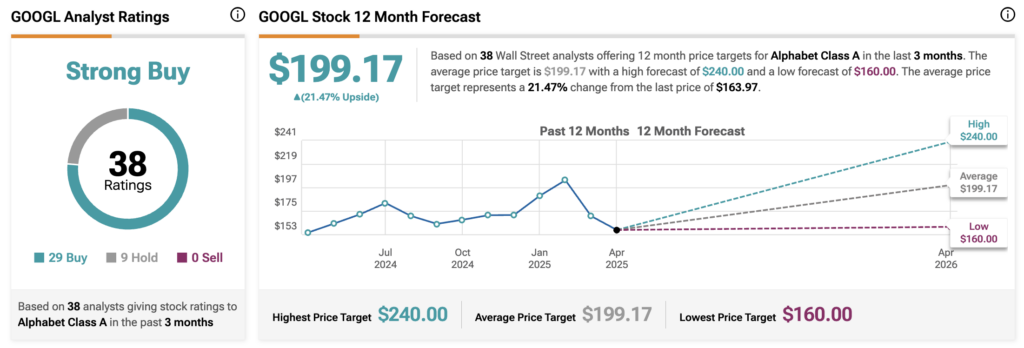

Despite the muted launch of its film AI tool, Wall Street analysts haven’t flinched. According to TipRanks, Alphabet stock still commands a Strong Buy consensus based on 38 analyst ratings—with 29 Buys, three Holds, and zero Sells.

The average GOOGL price target sits at $199.17, suggesting over 21% upside from where shares currently trade. The high-end target goes as far as $240, while the lowest forecast dips to $160—a sign that sentiment remains bullish, but not without caution.