First Solar (FSLR), a U.S. solar panel manufacturer, surged 8.9% on Wednesday, hitting a new 52-week high of $248.04, after a wave of upbeat analyst reports reignited investor optimism. The rally followed Citigroup’s street-high price target hike to $300 from $198 and other upbeat analyst calls, showing stronger confidence in the solar maker’s U.S. expansion plans and rising demand for its products.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this move, First Solar’s stock year-to-date gain now stands at over 38%, underscoring its strong momentum in the clean energy sector.

Citi Analyst Sees Strong Catalysts Ahead

Citigroup analyst Vikram Bagri said the increase reflects rising confidence in First Solar’s U.S. production growth, which he views as a key driver for the company’s future. He pointed to several near-term factors that could support the stock, including new factory announcements, solid quarterly bookings, and favorable outcomes from ongoing trade and tariff reviews.

“An upcoming update on U.S. finishing capacity, steady bookings, a possible Section 232 ruling, and growing AI-related power demand should all help boost pricing and the stock,” Bagri wrote.

He added that First Solar’s unique technology, strong cash generation, and busy year of catalysts make it appealing to long-term investors, even with some policy-related uncertainty.

Other Analysts Echo the Bullish View

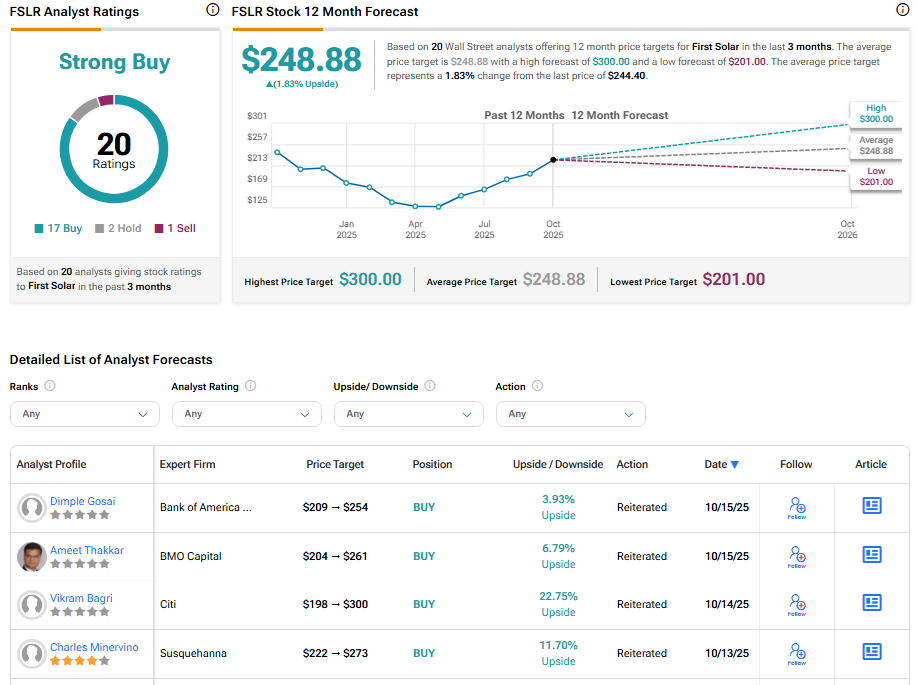

Analysts at Bank of America and BMO Capital Markets also maintained their Buy ratings on First Solar, while raising their price targets. Bank of America analyst Dimple Gosai lifted her target from $209 to $254, and BMO Capital’s Ameet Thakkar raised his target from $204 to $261, reflecting continued optimism about the company’s growth prospects.

BMO noted that U.S. solar module pricing continues to improve, supported by existing tariffs that create more room for domestic price gains and help keep U.S. prices above global levels.

Is FSLR a Good Stock to Buy Now?

Turning to Wall Street, FSLR stock has a Strong Buy consensus rating based on 17 Buys, two Hold, and one Sell assigned in the last three months. Also, the average First Solar stock price target of $248.88 implies 1.83% upside from current levels.