Furniture and home décor retailer Big Lots (NYSE:BIG) posted worse-than-expected Q1FY23 results on May 26, dragging the shares down as much as 19% to their 30-year lows. What’s worse, the company’s board suspended its quarterly dividend distribution owing to the wider-than-expected adjusted loss of $3.40 per share. BIG stock sank 13.3% to close at $6.25 on Friday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A cutback on discretionary spending has impacted the retailer’s sales, which fell 18.3% year-over-year. The retailer also cited furniture shortages and unfavorable weather for the decline in sales in Q1.

In response to declining sales and contracting margins, management decided to shut down four distribution centers in an attempt to cut FY23 expenses by $100 million. Plus, the retailer has identified other avenues to increase earnings by up to $200 million in the next 18 months.

Commenting on the company’s efforts to boost its financials, CEO Bruce Thorn said, “We expect furniture and seasonal to return to being the strong growth drivers for our business they have been in the past, as consumer confidence improves and as we continue to bring newness and incredible value to our assortment.”

Steep inflationary pressures and the fear of an incoming recession have marred consumers’ buying habits in the past several months. In turn, retailers hiked up the prices of certain goods while resorting to promotional gimmicks for others to empty their shelves. Big Lots’ inventories in the first quarter also fell in tandem with its sales by 18.8% year-over-year.

Will Big Lots Stock Go Up?

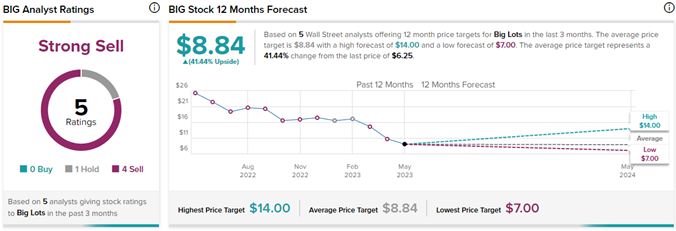

Following the latest quarterly results and the uncertain future, it is unlikely for the stock to move up in the short term. On TipRanks too, BIG stock has attracted a Strong Sell consensus rating based on one Hold and four Sell ratings. After falling nearly 80% this year, the average Big Lots price forecast of $8.84 implies 41.4% upside potential from current levels in the next twelve months.

Ahead of BIG’s latest earnings, Bank of America analyst Jason Haas reiterated a Sell rating on the stock with a price target of $7.20, implying 15.2% upside potential from current levels.