Shares of Applied Digital Corp. (APLD) rose 19.24% in trading on Monday, continuing their winning streak from the last week. Over the past five days, APLD stock has surged nearly 27%. The surge is mainly fueled by positive momentum from recent major contracts in the artificial intelligence (AI) infrastructure sector.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, Applied Digital specializes in large-scale data centers and blockchain mining operations. The firm focuses on providing energy-efficient solutions for AI and other high-performance computing needs.

What’s Happening with Applied Digital?

The recent surge came after Applied Digital announced expanded data center leases with cloud provider CoreWeave (CRWV) earlier this month. This lease will boost the total contracted capacity to 400 megawatts with expected future lease revenue of around $11 billion.

Along with this, the company announced major progress in its AI infrastructure business, signaling a shift from crypto-focused data centers to “AI Factories” and outlining growth plans in North Dakota and beyond.

These announcements underscore the company’s focus on high-performance computing for AI, a rapidly growing market. Moreover, the AI infrastructure sector is still in high demand, and Applied Digital’s connection to major players is notable, including its place in Nvidia’s (NVDA) AI investment portfolio.

Year-to-date, APLD stock has gained over 200%.

Options Traders Signal Bullish Trend in APLD Stock

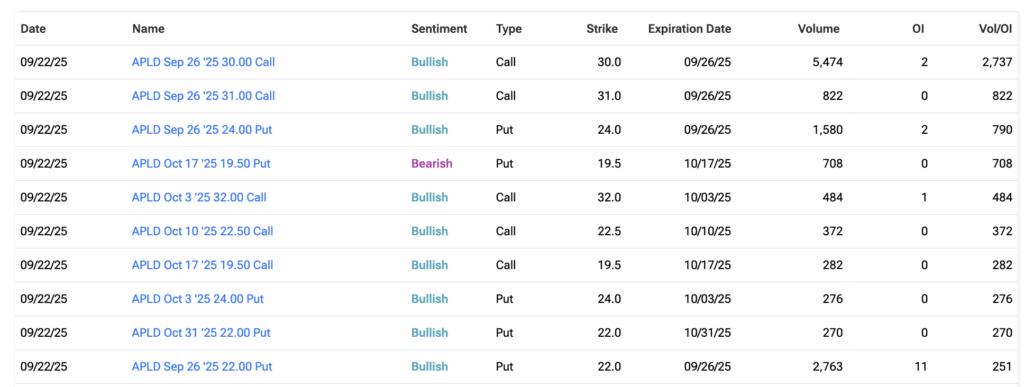

APLD stock is trading around $24.42 as of close on Monday, September 22. At the same time, options trading is much higher than usual, with 80,000 contracts exchanged and more call options than puts, indicating optimism among traders. To simplify, calls are bets that the stock will rise, while puts bet it will fall.

Using TipRanks’ Options tool, we can also see Unusual Options Activity for APLD, which is bullish.

Is APLD a Good Stock to Buy?

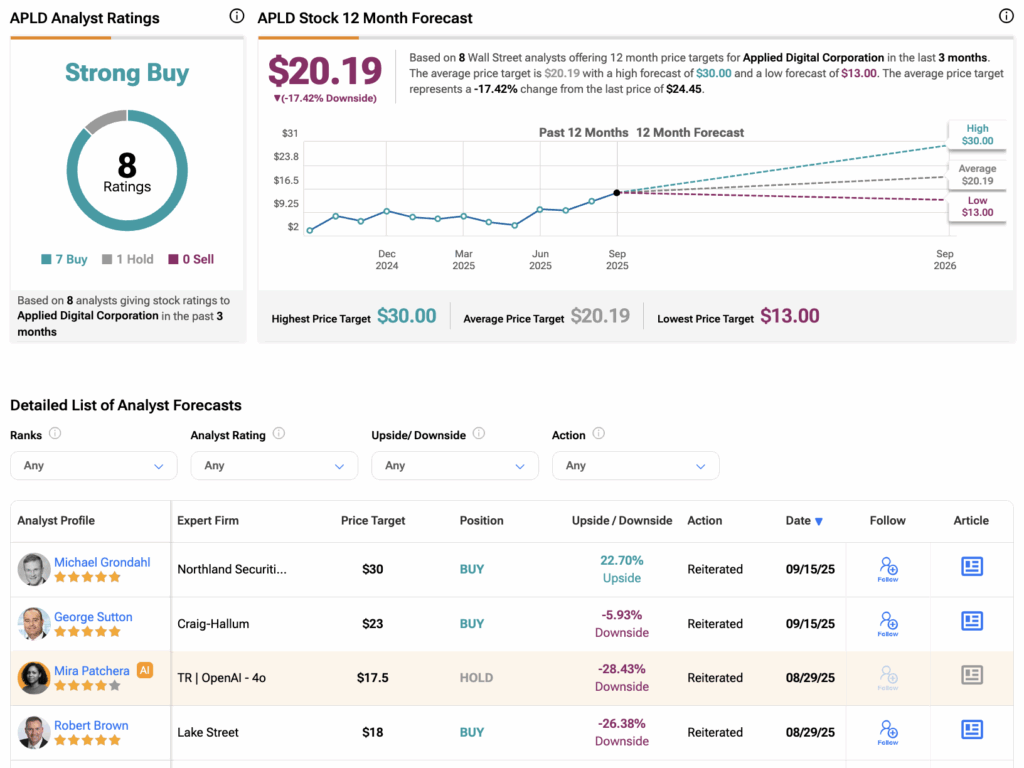

Turning to Wall Street, analysts have a Strong Buy consensus rating on Applied Digital stock based on seven Buys and one Hold assigned in the past three months. Furthermore, the average APLD stock price target of $20.19 per share implies 17.42% downside risk.