Apple (NASDAQ:AAPL) unveiled four new models of iPhone 15 on Tuesday. However, its stock closed 1.71% lower. The technology giant did not raise the prices of the iPhone 15 Pro and Pro Max (its pricier versions) as many expected. This explains the decrease in AAPL stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While Apple did not increase the price, it stated that the iPhone 15 Pro Max will now start with 256GB (Gigabyte) of memory, and the 128GB variant will no longer be available. Investors should note that the 256GB variant is about $100 pricier than the 128GB, thus leading to an improved sales mix.

Following Apple’s special launch event on September 12, Goldman Sachs analyst Mike Ng wrote to investors that though Apple kept prices unchanged on a “like-for-like basis,” the “iPhone 15 Pro Max will now start with 256GB (128GB no longer available), which should drive mix benefits to ASP [average selling price].” Further, the analyst expects carriers such as AT&T (NYSE:T) to offer launch promotions for the iPhone 15, which should support demand.

It remains to be seen how demand unfolds for the iPhone 15. Meanwhile, Apple stock has lost over 7% of its value in the last five trading days on reports of China imposing limitations on the use of iPhone and other foreign-branded mobile devices in the offices of certain government agencies. China is a key market for Apple (accounting for about 19.6% of sales for the first nine months of Fiscal 2023). Thus, restrictions on iPhone sales could hurt the company’s overall sales. With this backdrop, let’s look at what the Street recommends for Apple stock.

Is Apple a Buy, Sell, or Hold?

China’s decision to restrict iPhones in certain government enterprises is not a positive development for the company. However, Mike Ng expects the impact on Apple from the government ban to be minimal. Echoing similar sentiments, Citi analyst Atif Malik doesn’t see any material impact on Apple due to the restriction on iPhone usage.

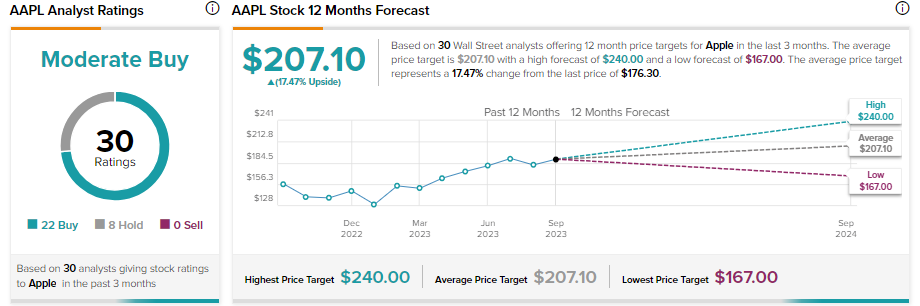

Nonetheless, increased competition and the stock’s premium valuation keep analysts cautiously optimistic. Apple stock has received 22 Buy and eight Hold recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $207.10 implies 17.47% upside potential from current levels.