SoundHound (SOUN) reported a strong Q3, beating both revenue and earnings expectations, yet its stock fell in after-hours trading. Investors remain cautious about SoundHound’s high valuation and the overall AI and growth stock market, showing that strong results don’t always ease concerns. Following the results, SOUN stock fell nearly 4% in after-hours trading on Thursday, and is down by 0.63% at the market open on Friday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, SoundHound AI focuses on voice recognition and natural language processing, delivering AI-driven solutions across multiple industries.

SoundHound’s Q3 Highlights

SoundHound reported Q3 revenue of $42 million, up 68% from a year ago, beating the $40.5 million analysts had expected. Meanwhile, the company posted an adjusted net loss of $0.03 per share, better than the $0.09 loss predicted and an improvement from last year’s $0.04 loss.

Looking ahead, SoundHound raised its full-year revenue forecast to $165–$180 million, above its previous $160–$178 million estimate. CEO Keyvan Mohajer said the company sees “enormous potential” and is positioning itself to capitalize on it.

Why Investors Are Cautious After SOUN’s Q3 Results

Investors are selling SOUN stock despite a strong Q3 beat because concerns over its high valuation and the broader AI and growth-stock market outweigh the positive earnings. While revenue jumped and adjusted losses were smaller than expected, the market remains cautious about profitability and whether the company can sustain its rapid growth.

Additionally, broader market concerns about a potential AI bubble and a concerning layoffs report continue to weigh on tech and AI stocks. Investors are also nervous about the government shutdown, which has now reached 38 days, the longest in U.S. history.

What Lies Ahead with SOUN Stock?

SOUN stock has traded in a 52-week range of $5.87 to $24.98, hitting its peak in late December 2024. The stock has fallen sharply recently, dropping more than 20% over the last 30 days. Looking at the long term, the recent pullback presents a potential buying opportunity for investors. Overall, analysts remain bullish on SoundHound’s growth prospects.

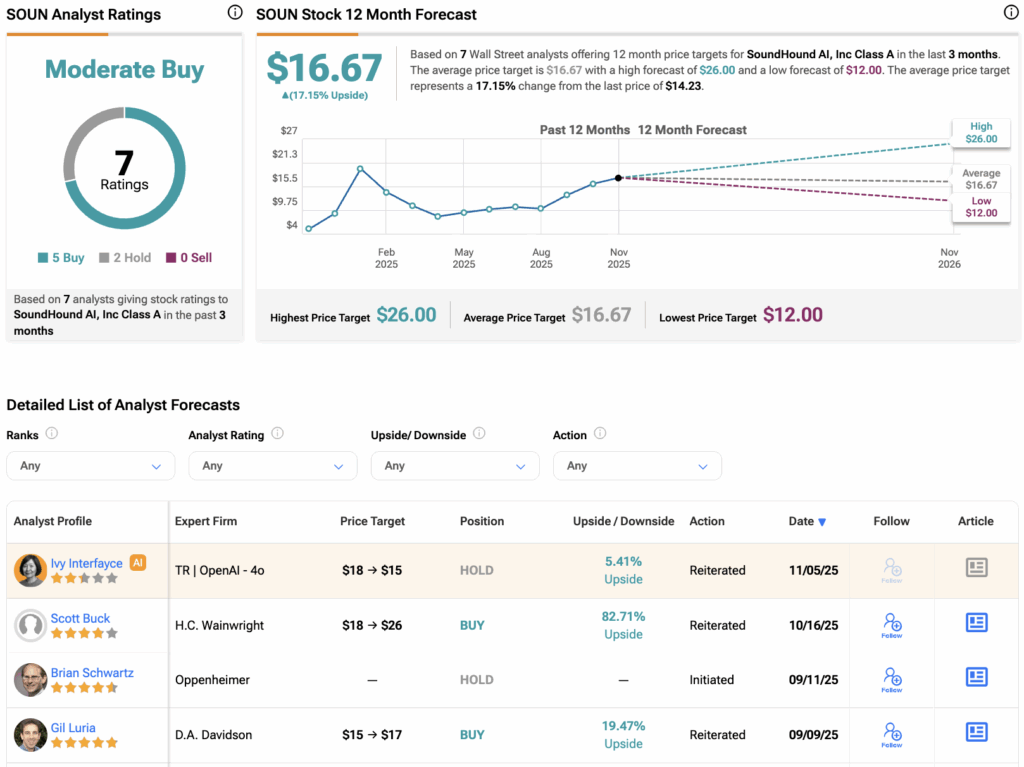

Last month, four-star-rated analyst Scott Buck of H.C. Wainwright raised his price target from $18 to a Street-high of $26. Buck believes SOUN’s real growth will emerge as more industries adopt its voice AI technology. That will allow the company to scale its business, potentially driving stronger gains in SOUN stock in the coming months.

While analysts emphasize SoundHound’s long-term potential, traditional valuation metrics tell a different story. The company’s forward price-to-sales ratio stands at 34.94x, far above the industry average of 3.56x, highlighting significant valuation risk for near-term investors.

What Is the Price Target for SOUN?

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with five Buys and two Holds assigned in the last three months. The average SoundHound stock price target is $16.67, suggesting a potential upside of 17.15% from the current level.