Archer Aviation (NASDAQ:ACHR) shares soared ~18% on Monday after a cryptic post from Tesla set investors buzzing. The EV giant’s official account teased a “significant announcement” coming Tuesday, accompanied by a short video showing a spinning rotor with the Tesla logo. That was enough to ignite speculation that Elon Musk’s company could be hinting at some kind of aviation or drone-related venture, and traders immediately bet on spillover excitement for electric-aircraft names.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Beyond today’s social-media-driven rally, investor Steven Porrello sees tangible catalysts ahead for Archer. “The next event that could send Archer stock soaring would be the Midnight receiving its type certification from the Federal Aviation Administration (FAA),” Porrello wrote. That approval would allow the company to carry paying passengers – the final hurdle between Archer and its commercial debut.

Porrello notes that Archer already holds Part 141 certification for pilot training and Part 135 to begin operations, while it continues to pursue full FAA type certification for its Midnight aircraft. Government support could help smooth the path: Archer is taking part in a U.S. eVTOL pilot program that could lead to trial operations by 2026. The company has also been tapped as the official air-taxi provider for the 2028 Los Angeles Olympics, a global showcase that could spotlight its technology in a city famous for gridlock.

Still, Porrello calls the vision “a moonshot.” Archer must spend heavily to build aircraft, vertiports, charging networks, and pilot teams before any meaningful revenue arrives. Yet, with a $6 billion order book and $1.7 billion in cash, the company’s balance sheet gives it some runway.

So while Monday’s rally may have started with a Tesla tease, Archer’s long-term ascent will depend on real-world milestones – not social-media momentum.

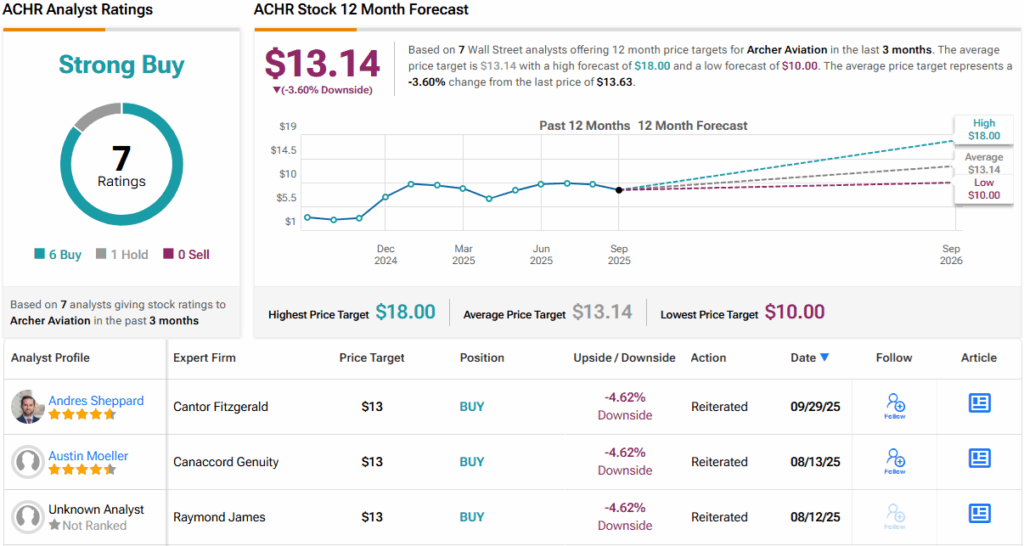

Wall Street seems optimistic. Based on 6 Buys and 1 Hold, ACHR carries a Strong Buy consensus rating. Still, after its stellar run this year, the average price target implies about 4% downside from current levels, suggesting analysts may soon need to revisit their models to keep up with the stock’s momentum. (See ACHR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.