Among the top three global hyperscalers today, Amazon (AMZN) has been the clear laggard this year, at least in terms of stock performance. Even though the Seattle-based company now operates a widely diversified business across e-commerce, cloud, and adjacent services, market perception has been heavily influenced by the slower growth of Amazon Web Services (AWS)—its most profitable segment, which drives much of the company’s valuation and earnings multiple.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As Amazon approaches its September quarter earnings report, scheduled for October 23, expectations are that we may finally see a turning point in this year’s performance.

Although Amazon remains exceptionally well-positioned to capitalize on secular AI tailwinds (and is still the undisputed cloud leader), despite an extremely optimistic sell-side consensus, I argue that a meaningful turnaround is unlikely in the short to medium term if AWS growth lags its main hyperscaler peers or if margins fail to show some strength.

Even so, while short-term weaknesses may persist for Amazon shareholders longer than expected, I continue to view AMZN as a long-term hold and maintain a Buy rating at current levels.

AWS Walking the Tightrope

Amazon still hasn’t fully recovered from the stumble it had in the previous quarter. In its June quarter, even though it comfortably beat top and bottom-line expectations from the Street, the results were met with widespread skepticism, and for good reason: the spotlight remains on AWS, the company’s most important segment for the bottom line.

To recap briefly, AWS is still growing—and strongly—but not as strongly as expected. In Q2, AWS posted 17% annual growth, matching the pace of Q1 and falling short of the 19% growth reported over the prior three quarters. The difference this time was that expectations were high as analysts were looking for 20–22% annual growth.

The optimism stemmed from Q1, when Amazon said the sequentially weaker AWS growth was caused by capacity issues, not demand. The market interpreted those headwinds as temporary, and so Q2 expectations assumed a return to higher growth. On top of that, in Q1, Microsoft Azure (MSFT) and Google Cloud (GOOGL) had already surprised positively, with growth accelerating—especially Azure, which grew 33% year-over-year, well above its historical 14–18% range.

When AWS growth came in flat versus Q1, it reignited concerns that capacity constraints may not be easing as quickly as expected — an issue analysts had already flagged. It also raised the possibility that demand might be softer than assumed, though that seems unlikely given the strength of overall hyperscaler spending. More worryingly, it could signal that competition from Azure and Google Cloud is intensifying, hinting that the longtime cloud leader may be starting to lose ground.

The Cloud Race Heats Up

Arguably, there are specific strategic and operational reasons why Microsoft Azure and Google Cloud have recently pulled ahead of AWS in growth. It seems that the market has reached a point where hyperscalers are finally positioning their cloud businesses as AI-first platforms, building application layers on top of infrastructure.

To explain, AWS has historically focused on infrastructure leadership, letting customers build their own stacks. For a long time, this was an advantage—it offered flexibility and likely fueled AWS’s explosive growth over the years. But today, many enterprises prefer pre-integrated AI solutions, which Azure and Google Cloud provide more seamlessly.

Both Azure and Google Cloud are much more deeply integrated with their generative AI offerings. Azure, for example, has a first-mover advantage thanks to its partnership with OpenAI, which drives workloads directly into its infrastructure. Google Cloud benefits from its own foundation model, Gemini. Meanwhile, AWS relies on Bedrock and Trainium for its AI platform strategy—both powerful tools, but adoption hasn’t scaled at the same pace as its peers.

Margins and Growth Could Re-rate Amazon

Another key point in Amazon’s thesis around its cloud business has been the sharp decline in AWS operating margins. In Q2, margins came in at 32.9%, down from 39.5% in Q1—the weakest level in at least the past six quarters. Still, the explanations are plausible.

Amazon has significantly increased CapEx to support AI demand, which results in higher depreciation and operating expenses, putting short-term pressure on margins. In Q2, roughly $31.3 billion was allocated to CapEx (labeled as purchases of property and equipment on Amazon’s financial statements)—the highest in the company’s history for a single quarter—representing almost 19% of total revenue, up from 15.6% in Q1 and 13.4% in Q4.

Looking ahead to Q3, two main factors could move the needle for Amazon: acceleration in AWS growth and a better margin trajectory.

Even a modest acceleration—say 18–19% year-over-year—could be read as a turning point, signaling that demand is holding up and capacity constraints are easing. If AWS margins also stabilize or tick up slightly, despite the massive CapEx, it would suggest that capacity utilization is improving and pricing pressure isn’t worsening.

If these two trends converge favorably, the stock could be re-rated, as AWS drives the most significant portion of Amazon’s operating profit and the company currently trades at a 33x earnings multiple.

Is AMZN a Buy, Hold, or Sell?

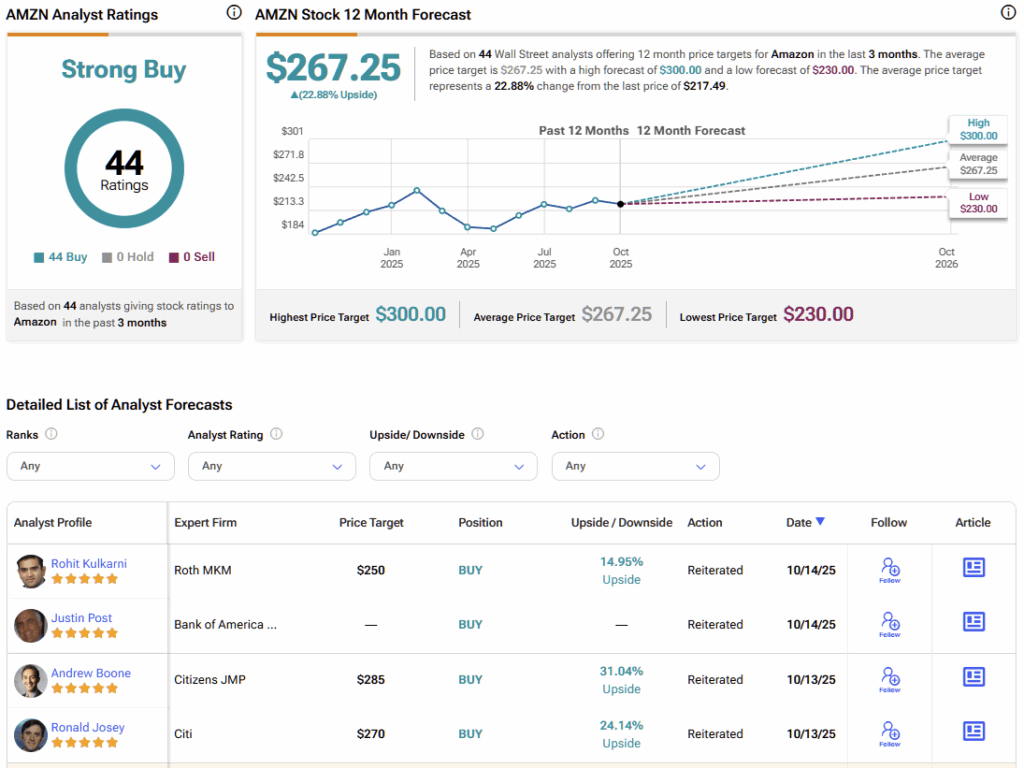

Wall Street sentiment couldn’t be more bullish. All 44 analysts covering the stock over the past three months are recommending a Buy on AMZN. Their average price target sits at $267.25, implying an upside potential of almost 23% over the next 12 months.

Amazon on the Comeback Trail

Amazon’s stock has been disappointing all year. Much of the recent underperformance is tied to the slowing growth pace of AWS. Persistent and frustrating capacity issues over recent quarters have been the excuse for more timid growth in the company’s most profitable segment. While demand for cloud services doesn’t seem to be the problem, a significant part of the challenge may also stem from AWS being in a structurally less favorable position than its peers to sustain faster growth.

Even though valuation discussions and Amazon’s diversification beyond cloud might support a thesis of ultra-optimism at these depressed price levels, I would argue that a re-rating of the stock will likely only come through stronger AWS sales and margin growth to offset persistent concerns.

The September quarter may not be the moment when this happens in a big way, but there’s a good chance minor improvements—entirely plausible—could trigger a short-term market reaction. Having said that, with AI demand still the main driver, it seems only a matter of time before Amazon better structures itself to capitalize on and monetize this demand versus capacity. For that reason, I continue to view Amazon as a long-term Buy.