Shares of high-performance server and storage solutions provider Super Micro Computer (NASDAQ:SMCI) have jumped nearly 205% year-to-date, outperforming the S&P 500 Index’ (SPX) gain of 7%. The company benefits from solid demand for its artificial intelligence (AI)-optimized computer platforms and rack-scale Total IT Solutions. As the company is poised to gain from AI-driven demand, it’s the right time to delve into its ownership structure.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

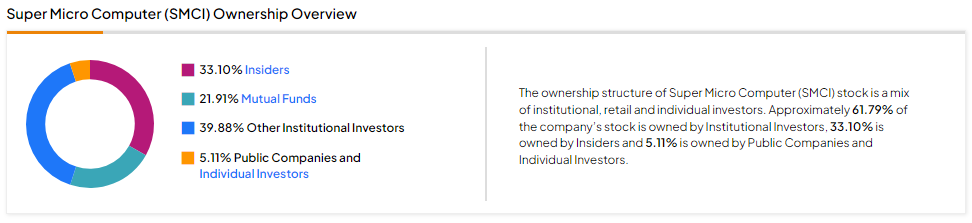

Now, according to TipRanks’ ownership page, other institutional investors own 39.88% of SMCI. They are followed by insiders, mutual funds, and public companies and individual investors at 33.10%, 21.91%, and 5.11%, respectively.

Digging Deeper into SMCI’s Ownership Structure

Among corporate insiders, Chiu-Chu (Sara) Liu Liang and its CEO Charles Liang each own an 11.92% stake in SMCI. Looking closely at institutions (Mutual Funds and Other Institutional Investors), iShares owns a 9.47% stake in SMCI stock. Next up is Vanguard, which holds an 8.35% stake in the company.

Among the institutions, the Hedge Fund Confidence Signal is Negative on Super Micro Computer stock based on the activity of 13 hedge funds. Hedge funds decreased their SMCI holdings by 24.9K shares in the last quarter.

In contrast to hedge funds, individual investors have a Very Positive view of the company, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 44.1%. Overall, among the 718,197 portfolios monitored by TipRanks, 1.4% have invested in SMCI stock.

What is the Forecast for SMCI?

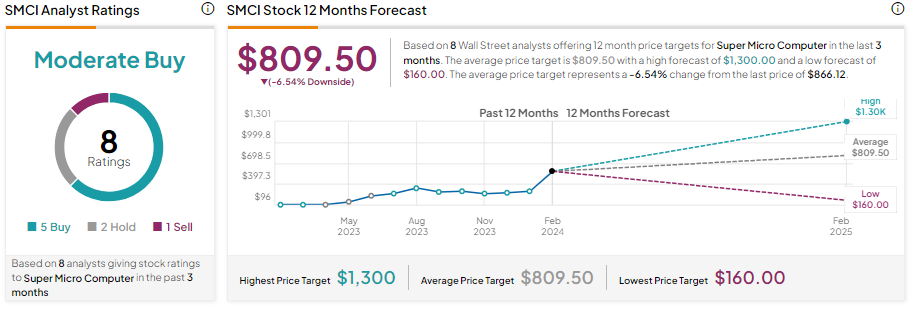

Wall Street is cautiously optimistic about SMCI stock. It has five Buy, two Hold, and one Sell recommendations for a Moderate Buy consensus rating. Further, due to the recent rally, analysts’ average price target of $809.50 implies 6.54% downside potential.

Conclusion

TipRanks’ Ownership tool provides SMCI ownership structure by category, enabling investors to make well-informed investing decisions.