Whiting Petroleum plans to cut its workforce by 16%, to save $20 million in annualized costs. The oil and gas company also provided production guidance for the second half of 2020, sending shares up 3.3% in pre-market trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition to the job cuts, Whiting Petroleum (WLL) is reducing the compensation of its officers by 15% to 20% and realigning officer bonus programs to reduce the number of corporate executives.

The company expects production in the second half of 2020 to be in the range of 88 to 92 MBOE/d (thousand barrels of oil equivalent per day). Capital expenditure is forecast to be between $34 million to $39 million in the second half of 2020. (See WLL stock analysis on TipRanks).

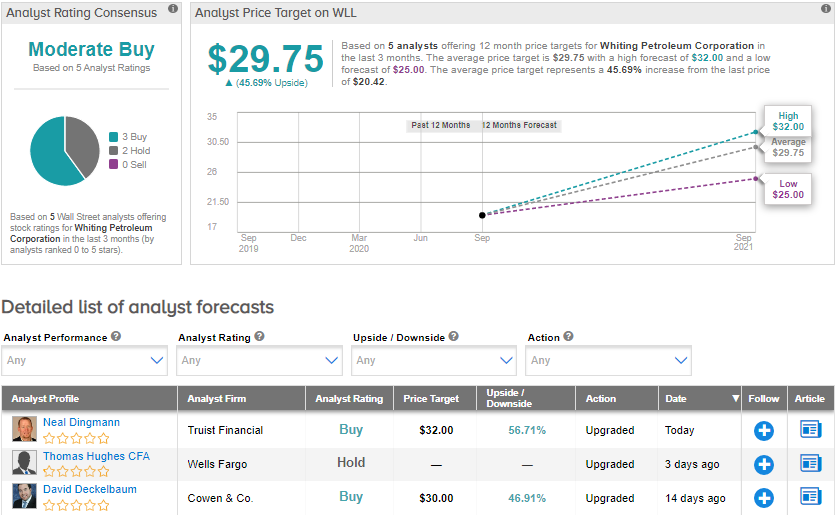

On Sept. 3, KeyBanc analyst Leo Mariani upgraded the stock to Buy from Hold, after the company emerged from Chapter 11 bankruptcy protection this month. Mariani maintained a price target of $25 (22.4% upside potential), saying that Whiting is uniquely positioned for mergers & acquisitions activity in the Bakken shale. The analyst expects the company to generate positive free cash flow in 2020 and 2021.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 3 Buys and 2 Holds. The average price target of $29.75 implies upside potential of about 45.7% to current levels. Shares have gained 4.7% since Sept. 2, after the company emerged from bankruptcy.

Related News:

Sony’s PS5 Will Go On Sale For $499 In November

Illumina Eyes Grail Acquisition For Over $8B – Report

Raytheon Plans To Cut Over 15,000 Jobs Due To Aviation Crisis