Amid higher interest rates and tepid consumer demand, solar energy stocks have largely struggled so far this year. Shares of microinverter-based solar and battery systems provider Enphase Energy (NASDAQ:ENPH) have tanked nearly 69% over the past year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s recent third-quarter performance was marked by a sequential drop in revenue to $551.1 million from $711.1 million. Additionally, its EPS fell to $0.80 from $1.09 despite an improvement in gross margin. Amid a challenging business environment, its U.S. revenue plummeted by 16%, and revenue in Europe decreased by 34% owing to high inventory levels at its distribution partners.

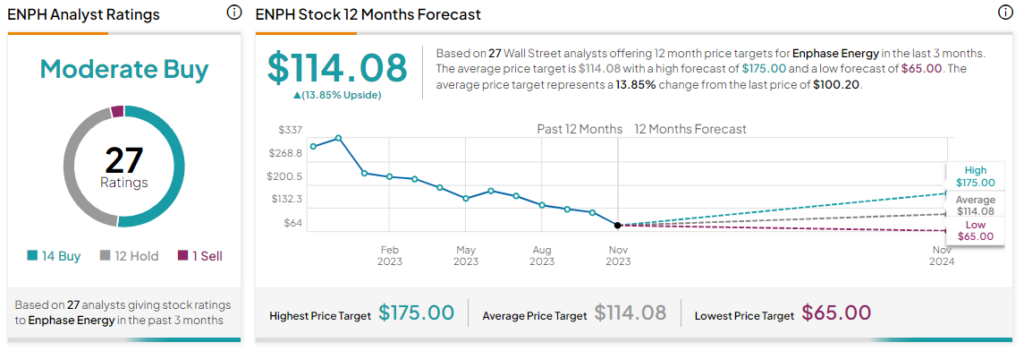

While the company is introducing new products and expanding product shipments to multiple markets, Bank of America’s Julien Smith has maintained a Sell rating on the stock and lowered the price target to $65 from $76. Smith expects volumes for the company to recover only in the second half of 2024 after a softer first half.

In contrast, Mizuho’s Maheep Mandloi recently initiated coverage on Enphase with a Buy rating and a more optimistic $131 price target. Furthermore, Enphase Energy has rallied nearly 33% over the past few sessions on optimism from the recent U.S. inflation report. The soft inflation print could potentially lead to a pause in rate hikes from the U.S. Fed.

Is ENPH a Buy, Sell, or a Hold?

Overall, the Street has a Moderate Buy consensus rating on Enphase, and the average ENPH price target of $114.08 implies a modest 13.8% potential upside. In addition, despite challenging conditions, Wall Street is maintaining faith in major solar stocks, as long-term growth prospects for these names still remain bright.

Read full Disclosure