Shares of Bitcoin miner and data center operator Core Scientific (CORZ) accelerated on Thursday after its shareholders threw out a $9 billion acquisition offer from AI infrastructure provider CoreWeave (CRWV).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The termination likely marks the end of the line for one of the most-watched deals in the AI data center industry. So, what’s next for Core Scientific?

It is important to note that the breakdown of the proposed merger happened after CoreWeave, backed by American chip designer Nvidia (NVDA), refused to revise its bid despite vocal disapproval from Core Scientific shareholders. The shareholders argued that the proposal undervalues Core Scientific.

CoreWeave believes that its all-stock offer is fair and matches the Bitcoin miner’s market value. Its chief executive Michael Intrator even noted that Core Scientific is not indispensable to the AI cloud computing company’s plan. Evercore ISI analyst Amit Daryanani recently backed that sentiment.

But where does that leave Core Scientific?

Here’s What Wall Street Thinks

According to alternative investment manager Two Seas Capital, which alongside proxy advisor ISS criticized CoreWeave’s offer, Core Scientific has “standalone prospects”, even as the AI investment boom continues.

The asset company, which is also one of the data center operator’s largest shareholders, noted that Core Scientific can ride on its “access to low-cost power and expertise in site construction and management.”

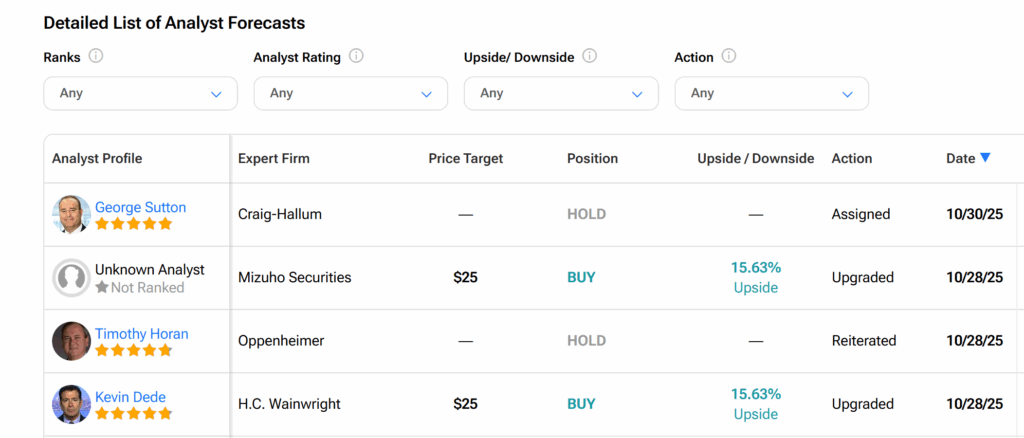

Similarly, H.C. Wainwright analyst Kevin Dede, who recently upgraded Core Scientific’s stock to a Buy, observed that the company has the “technical savvy” for AI compute. The five-star analyst pointed out that Core Scientific continues to build out its infrastructure “at velocity and low cost.”

In the same vein, Cantor Fitzgerald’s five-star analyst Brett Knoblauch, who recently raised his price target on Core Scientific, sees “attractive risks and rewards” for the company, whether it merges with CoreWeave or goes solo in its effort to build high-performance computing capacity.

Is CORZ a Good Stock to Buy?

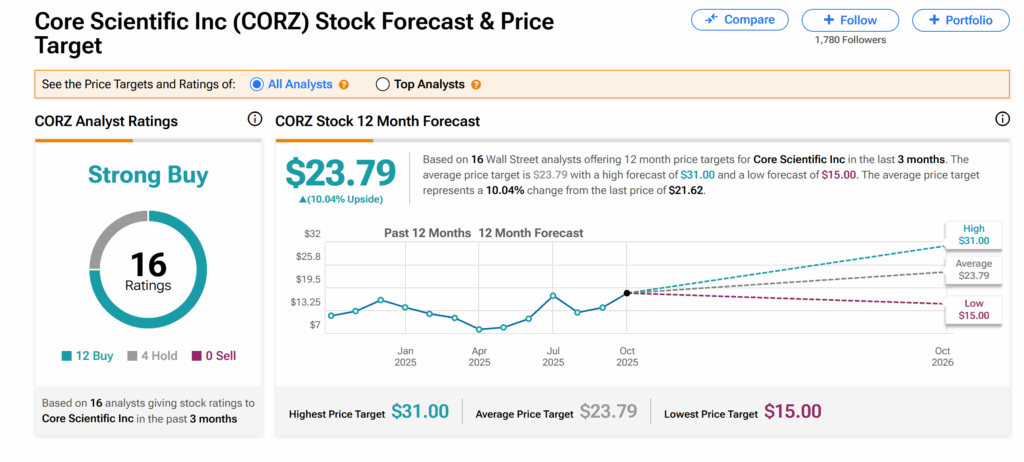

Across Wall Street, analysts remain very confident about Core Scientific’s shares. The stock currently boasts a Strong Buy consensus from analysts based on 12 Buys and four Holds issued over the past three months.

Moreover, the average CORZ price target of $23.79 suggests a 10% upswing from the current level.