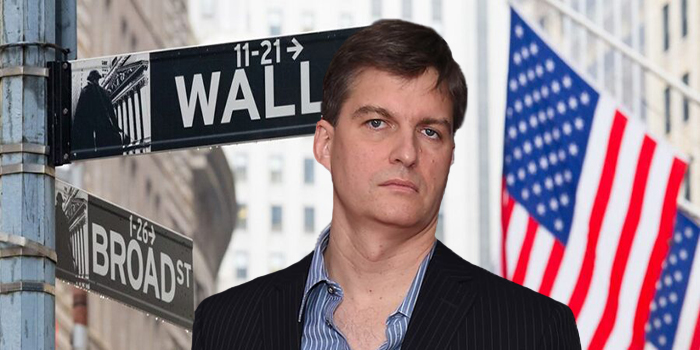

Michael Burry has been on a buying spree lately. We know that he’s recently bought big on Geo Group (NASDAQ:GEO), despite its less-than-stellar performance of late. However, his other picks might surprise you. Michael Burry does see a recession coming, but that hasn’t stopped him—rather his hedge fund Scion Asset Management—from stocking up on some positions likely to be hit hard by a downturn.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For instance, consider the 75,000 shares of JD.com (NASDAQ:JD), the 50,000 shares of Alibaba (NASDAQ:BABA), or the 100,000 shares of MGM Resorts International (NYSE:MGM). Then there are the 1.5 million shares of Qurate Retail (NASDAQ:QRTEA), a company that specializes in “video commerce.”

Of course, buying heavily in retail stocks in the fourth quarter of the year isn’t exactly a bad idea. Holiday season shopping tends to goose the fortunes of most any retailer, if only in the short term. Further, it’s not immediately clear how much of these holdings Scion still actually holds. Burry himself posted a tweet just a couple weeks ago saying, “Sell.” If that turned out to be the plan, then Burry might be divesting a ton of about-to-be-hit retail stocks in the near future if that hasn’t already happened.

Of the five stocks mentioned, each presents different risks and advantages. For instance, JD.com, Alibaba, and MGM Resorts are all considered Strong Buys by analyst consensus. Analyst consensus calls Geo Group a Moderate Buy and Qurate a Hold. But Qurate also comes with 20.17% downside risk thanks to an average price target of $1.90, while JD.com offers 62.78% upside potential thanks to its average price target of $85.36.