Microsoft (NASDAQ:MSFT) is set to release its FY 2026 Q1 earnings later today after the market closes, and investors are eager to understand what lies in store.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

After some rain clouds during the early part of 2025, the sun has been shining on Microsoft over the past few months. MSFT’s share price has risen some 38% during the past half year and is up nearly 30% year-to-date.

Microsoft’s FY 2025 Q4 earnings showed both top- and bottom-line growth, with revenues of $76.4 billion up 18% year-over-year and net income of $27.2 billion up 24%.

A recent restructuring deal with ChatGPT maker OpenAI offers further reasons for optimism. Among other developments, OpenAI will be purchasing $250 billion worth of Microsoft Azure services.

Will the upcoming earnings release provide additional fodder for bulls? Investor Daniel Foelber is more focused on the bigger picture rather than the about-to-be-announced earnings.

“Microsoft doesn’t need to grow earnings at a breakneck rate to be a winning investment,” explains the 5-star investor.

Foelber points out that Microsoft enjoyed solid revenue growth throughout fiscal 2025, propelled forward by a litany of products spanning cloud, gaming, and consumer electronics. Moreover, the investor notes that Microsoft has succeeded in using AI to support earnings, which have been increasing at a faster rate than sales.

“Microsoft’s future results aren’t based on one big idea paying off, but rather several different ideas working in concert,” adds the investor.

In this way, Microsoft has the benefit of being a growth stock, even as its “rock-solid” finances, size, and global diversity provide a robust bulwark against potential economic downturns up ahead, posits Foelber.

The investor also cites Microsoft’s large amount of free cash flow, which allows the company to explore and try out new ventures. Foelber deems this “cushion” particularly important for the always evolving tech sector.

“All told, Microsoft makes a lot of sense for investors looking to invest in themes like AI and cloud computing without paying a price that depends on everything going right at once,” sums up the investor. (To watch Daniel Foelber’s track record, click here)

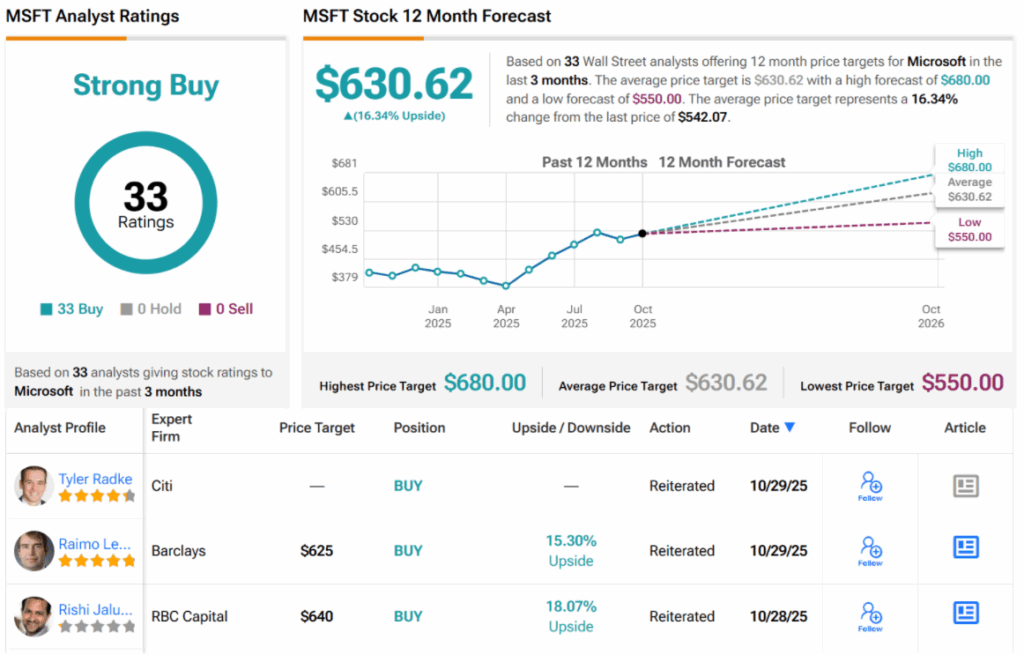

Wall Street is A-OK with Microsoft as well. Its 33 Buy ratings – with nary a single Hold or Sell – give the company a Strong Buy consensus rating. MSFT’s 12-month average price target of $630.62 implies gains of ~16%. (See MSFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.