With its vast online learning platform, Udemy (NASDAQ:UDMY) holds a distinct position at the rapidly evolving intersection of e-commerce and e-education. While recent financial results exceeded expectations, the market’s response was less than enthusiastic, and the shares sharply declined. The company has taken proactive measures to shore up the stock, and there is optimism that more robust earnings lie ahead. Given its rich valuation, investors might want to wait for confirmation that things have taken a turn for the better.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Focus on Enterprise Customers

Udemy specializes in education technology and operates an expansive online platform for learning and teaching.

The company operates in two segments: the Consumer segment, which targets individual learners, and the Enterprise segment, which assists business and government entities in upskilling their workforce.

The Enterprise segment is the fastest-growing area of the business and now accounts for over 61% of total revenue. The company is particularly focused on retaining and growing these enterprise customers, adding relevant training, such as the recent rollout of the “GenAI Skills Pack,” to support organizations worldwide with the rapid adoption and implementation of in-demand generative AI (GenAI) skills.

Recent Results & Future Outlook

Udemy reported Q4 EPS of $0.02, beating the consensus of -0.02, and revenue of $189.5M, a 15% year-over-year increase, surpassing the consensus estimate of $186.05 million. The company finished the quarter with $480.9 million in cash, cash equivalents, restricted cash, and marketable securities on the balance sheet.

Despite a “challenging operating environment,” the company remains optimistic about long-term growth opportunities. Management projects Q1 revenue between $193M and $196M, with FY24 revenue between $795M and $810M.

Where the Stock Stands Now

The stock had been trending up over the past year. However, despite positive earnings in Q4, management’s comments on the operating environment and future guidance caused market participants to reevaluate, and the stock fell 23% the next day. The recent price is trading towards the lower middle of its 52-week range of $8.17-$16.01. The decline in price momentum has led the shares to trade below the 20-day (11.39) and 50-day (12.21) moving averages.

Despite the recent price correction, the stock appears richly valued based on comparative metrics. The P/S ratio of 2.3x sits above the averages for the Consumer Defensive sector (1.2x) and the Education & Training Services industry (1.8x).

Negative price momentum and rich valuations are cautionary flags for prospective investors. To help shore up the stock, the Udemy board of directors approved a share repurchase program, authorizing the purchase of up to $100 million of the company’s common stock. That is certainly a step in the right direction, but investors will want to see further positive developments in the near term to ensure that things are improving.

What is the Price Forecast for UDMY in 2024?

Analysts covering the stock have been cautiously optimistic. For example, Citi analyst Thomas Singlehurst recently reiterated a Buy rating on the shares while decreasing the price target from $22 to $20. He anticipates that the downward pressures on growth will be temporary, and the $100 million buyback will provide a cushion for the stock.

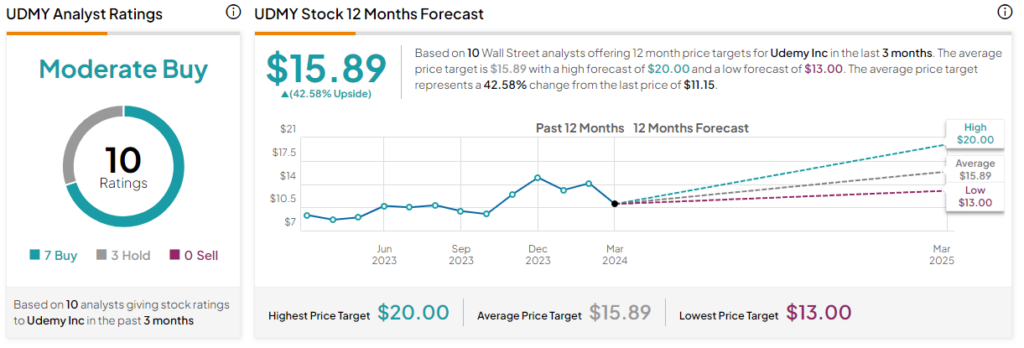

Based on ten analysts’ stock ratings in the past three months, Udemy is listed as a Moderate Buy. The average UDMY price target of $15.89 represents an upside potential of 42.58% from current levels.

Big Picture for UDMY

Despite the recent market turbulence and downward shift in Udemy’s stock prices, the strategic measures undertaken by the company, combined with the projected upward trajectory of the online education sector, suggest room for growth. Considering Udemy’s rich valuation in comparison to its industry peers and the current negative market sentiment, investors will want to look for more signs of progress before adding this stock to their portfolios. The next round of earnings in late April should help in that regard.