Top financial institutions warn of the looming recession, yet the market cap of luxury brands continues to head north on the back of solid demand. For instance, LVMH Moet Hennessy Louis Vuitton’s (GB:0HAU)(LVMUY) market cap touched $500 billion yesterday despite concerns about the economic slowdown. LVMH also became the first European company to hit $500 billion in market value.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

LVMH stock has gained about 30% year-to-date, reflecting strong performance across its business groups. Its top line came in at €21 billion in Q1 of 2023, up 17% year-over-year. The fashion house highlighted that Europe and Japan continued to witness robust demand from local and international customers. At the same time, Asia marked a significant rebound following the easing of COVID-led lockdowns. Furthermore, sales in the United States continued to deliver steady performance.

Highlighting the strong performance of LVMH, Goldman Sachs analyst Louise Singlehurst said that the group’s solid Q1 performance will lead to further market share gains. Singlehurst reiterated the Buy recommendation on LVMH stock.

What’s the Prediction for LVMH Stock?

The recovery in Asia (primarily China), ongoing momentum in the U.S., and strength in Europe and Japan will likely support the financial performance of LVMH. Meanwhile, price increases and a loyal customer base remain positives.

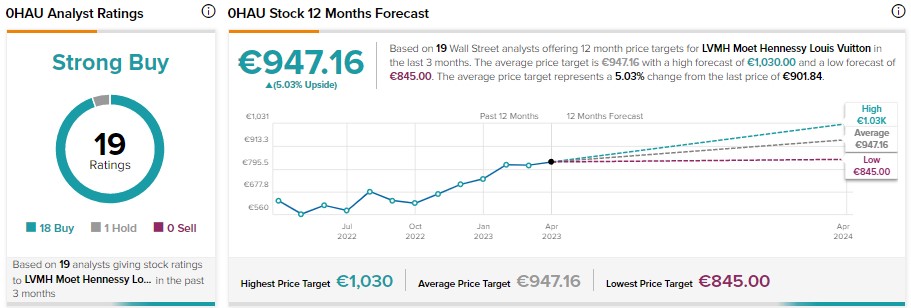

Analysts are bullish about LVMH stock. Including Singlehurst, LVMH has received 18 Buy and one Hold recommendations, translating into a Strong Buy consensus rating on TipRanks. These analysts’ average price target of €947.16 implies 5.03% upside potential.