Tesla (TSLA) stock is a hot topic among traders on Thursday as they react to the EV company’s latest earnings report. This has some wondering what the maximum and minimum potential of TSLA stock is in light of the latest analyst updates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

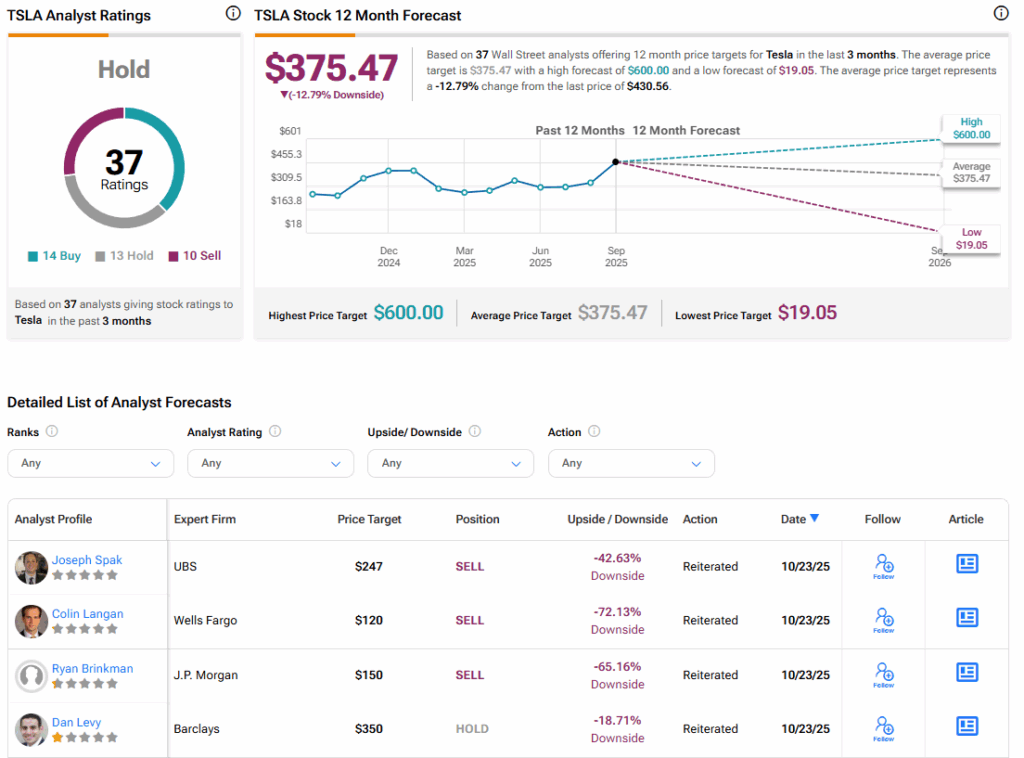

On the high end of the Tesla stock coverage is five-star Wedbush analyst Dan Ives with a Buy rating and a $600 price target, representing a potential 41.14% upside for the shares. Ives argued that his Street-high price target is warranted after the EV maker reported revenue that came in well above Wall Street’s estimates. The analyst also has high hopes that the company’s strategic partnerships and AI chip technology will enhance its capabilities and give it a competitive edge.

On the flip side of that, GLJ Research analyst Gordon Johnson has the most bearish stance on Tesla stock, with a Sell rating and a price target of $19.50, suggesting a possible 95.52% downside for the shares. Johnson is critical of Tesla’s current sales mix, which he believes has been boosted by increased deliveries ahead of the U.S. tax credit expiration. He also questioned the reliance on Elon Musk’s optimistic narrative and argued it could be behind TSLA stock’s high price instead of strong fundamentals.

Tesla Stock Movement Today

Tesla stock was down 1.82% on Thursday but remained up 6.73% year-to-date. The stock has also rallied 68.52% over the past 12 months. Trading activity today included some 46.9 million shares, compared to a three-month daily average of about 94.7 million units.

Is Tesla Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Tesla is Hold, based on 14 Buy, 13 Hold, and 10 Sell ratings over the past three months. With that comes an average TSLA stock price target of $375.47, representing a potential 12.79% downside for the shares. These ratings and price targets will likely change as additional analyst coverage rolls in after the company’s earnings report.