Bausch Health Companies (NYSE:BHC) has dropped plans to list its aesthetic medical devices unit, Solta Medical, through a U.S. initial public offering. Though the reasons for the withdrawal of its IPO plan are not clear, it is possible that the challenging macroeconomic environment and a considerable dip in the company’s valuation are to blame.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Based in Canada, Bausch Health is a multinational specialty pharmaceutical company that deals in branded generic drugs, primarily for skin diseases, gastrointestinal disorders, eye health, and neurology.

The IPO application was filed in February with plans to raise about $100 million. Had the IPO been successful, it would have been the company’s second spinoff this year. In May, Bausch Health listed its eye health business and raised $630 million in proceeds.

In the latest earnings report, Bausch Health lowered its 2022 revenue guidance to $8 billion and $8.17 billion from the previous range of $8.05 billion to $8.22 billion. The company expects its performance to be impacted by forex headwinds.

Is BHC a Buy?

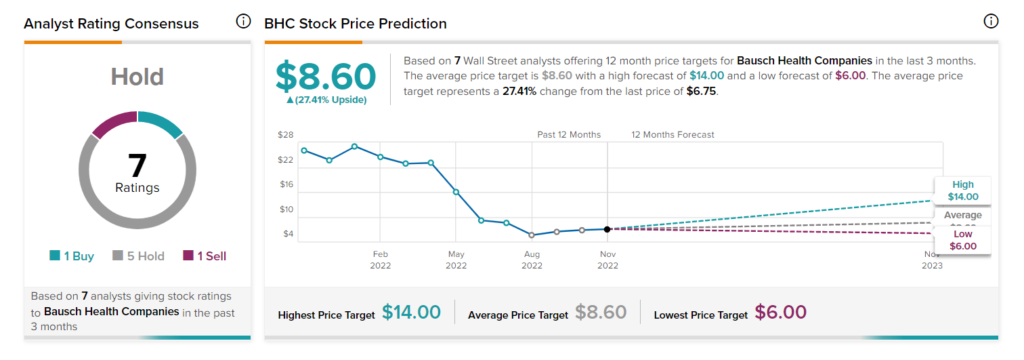

Currently, the stock’s valuation looks cheap, as the shares are down more than 75% this year. BHC is trading at a P/E ratio of 9.9x, reflecting a significant discount compared to the sector’s average multiple of 25.1x. So, this could be an opportune time to buy the stock.

Overall, the stock has a Hold consensus rating based on one Buy, five Holds, and one Sell. BHC’s average price target of $8.60 implies 27.41% upside potential from current levels.