Emergent Biosolutions (EBS) is a life sciences company based in Maryland but with a global footprint. It develops specialty products and offers contract manufacturing services.

Let’s take a look at the company’s latest financial performance, corporate developments, and risk factors.

Emergent Biosolutions’ Q2 Financial Results and 2021 Guidance

The company reported revenue of $397.5 million for the second quarter of 2021, compared to $394.7 million in the same quarter last year. Revenue fell slightly short of consensus estimates of $398.93 million. Adjusted EPS of $0.33 declined from $1.98 in the same quarter last year and missed consensus estimates of $1.54. Emergent ended Q2 with $447.7 million in cash and cash equivalents. (See Emergent Biosolutions stock charts on TipRanks).

For Q3, the company anticipates revenue in the range of $400 million – $500 million. It expects 2021 full-year revenue in the band of $1.7 billion – $1.9 billion.

Emergent Biosolutions’ Corporate Developments

The company secured FDA approval to resume the manufacturing of Johnson & Johnson’s (JNJ) COVID-19 vaccine at its Bayview plant. Vaccine production at the facility stopped because of quality problems.

Emergent said its Trobigard drug has been approved in Belgium for use in adults. Trobigard is designed as an emergency treatment for exposure to nerve agents.

The company will supply the Canadian government with its Anthrasil drug through March 2023 as part of the country’s anthrax preparedness efforts. Further, Emergent is supporting smallpox preparedness efforts in the U.S.

Emergent Biosolutions’ Risk Factors

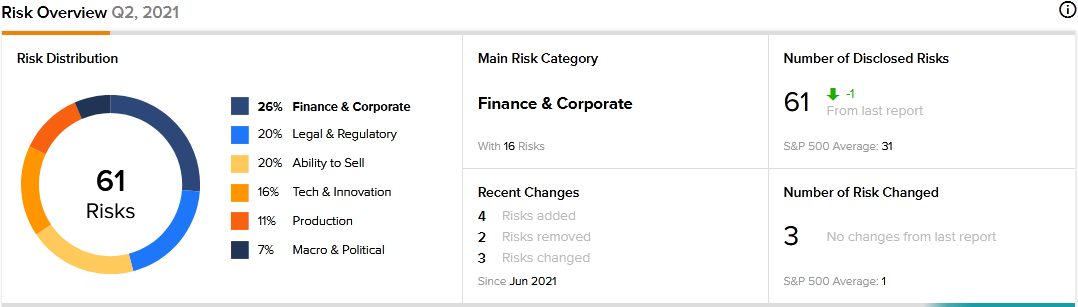

The new TipRanks Risk Factors tool reveals 61 risk factors for Emergent Biosolutions. Since December 2020, the company has added four additional risk factors.

The company tells investors that it is currently involved in many lawsuits, including class actions. It warns that any findings of liability could result in huge monetary damages and its operations may be adversely impacted.

Emergent says that failure to maintain quality at its Bayview manufacturing facility could prevent it from continuing to produce COVID-19 vaccines for Johnson & Johnson. It cautions that this could adversely impact its business and cash flow.

The company says it has been exposed to criticism from the media, people in government, and others as a result of its work on public health threats. It warns that the criticism could adversely affect its stock price, reputation, and ability to attract talent.

Emergent says it intends to expand internationally. But it cautions about the complex regulatory environment in foreign markets, saying it could face restrictions on product sales or be exposed to fines.

The majority of Emergent’s risk factors fall under the Finance and Corporate category at 26%. That is below the sector average at 29%. Emergent’s shares have declined about 33% since the beginning of 2021.

Analysts’ Take

In July, Chardan Capital analyst Keay Nakae reiterated a Buy rating on Emergent Biosolutions stock with a price target of $92. Nakae’s price target suggests 53.77% upside potential.

Consensus among analysts is a Moderate Buy based on 1 Buy. The average Emergent Biosolutions price target of $92 implies 53.77% upside potential to current levels.

Related News:

Walmart Issues Inaugural $2 Billion Green Bonds

Square Introduces Square Register in Canada; Shares Fall 4.2%

Paysafe Enhances Partnership with Betfred USA; Street Says Buy