Electric Last Mile Solutions (ELMS) is an American electric vehicle company focused on making vehicles for last-mile delivery service. Its flagship model is the Urban Delivery, which entered production in September and began shipping to customers the same month. It has a second model called the Urban Utility, whose production is set to begin in 2022. The company went public through a merger with a blank-check company in a transaction that helped it raise $294 million in capital. (See Analysts’ Top Stocks on TipRanks)

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a look at the company’s latest financial performance, corporate updates, and newly added risk factors.

Q2 Financial Results

Electric Last Mile Solutions did not report any revenue for Q2 2021 as it had not brought a product to the market yet. The company reported a loss per share of $0.10, better than the consensus estimate of a loss per share of $0.22. It ended Q2 with $217.4 million in cash.

ELMS estimates its capital expenditures in 2021 will be in the range of $25 million to $30 million. (See Electric Last Mile Solutions stock charts on TipRanks).

Corporate Updates

Electric Last Mile Solutions has entered the Canadian market as part of its global expansion. The company notes that the e-commerce boom in Canada is fueling demand for delivery vehicles. It also sees opportunities in Canada’s ambition to shift to zero-emissions cars and light trucks by 2035.

Electric Last Mile Solutions has opened a technology hub in San Francisco to serve its fleet customers. The hub will focus on offering solutions to increase vehicle productivity and lower ownership costs. The company has also opened its Asian supply chain and logistics center in China. The company counts on the Asian hub to help increase its speed to market and improve supplier engagement.

The company has tapped Randy Marion Automotive Group as a strategic distribution partner for its Urban Delivery vehicle. Randy Marion is among the largest commercial vehicle dealerships in the U.S. It has helped ELMS secure a purchase order for 1,000 units of its Urban Delivery vehicle.

ELMS has signed Cox Automotive to provide service and support solutions to its customers. The arrangement gives ELMS customers access to Cox Automotive’s nationwide network of more than 6,000 service centers and an additional 3,000 partner locations, as well as 800 mobile technicians.

ELMS plans to launch a battery swap solution that it hopes will lower initial vehicle costs for its customers. It is also looking at a solution that would allow customers to only pay for usage by the mile instead of owning the vehicle. It intends to begin testing the solution in Q4 2021 and roll it out by Q2 2022.

Risk Factors

Electric Last Mile Solutions carries 71 risk factors, according to the new TipRanks Risk Factors tool. Since June 2021, the company has updated its risk profile with 62 new risk factors.

Electric Last Mile Solutions tells investors that it has selected a specific court in Delaware as the exclusive forum for resolving lawsuits against it or its executives. But it cautions that it may incur additional costs if forced to settle lawsuits outside its preferred court. That could, in turn, have an unfavorable impact on its business and finances.

The company says that its charter contains provisions that could discourage a third party from acquiring it. Therefore, it could miss a takeover opportunity that could otherwise deliver great value to shareholders.

Electric Last Mile Solutions cautions investors that its business is capital intensive. However, it may not be able to obtain the capital needed on favorable terms to fund its operations. It warns that a lack of additional capital could have a significant adverse effect on its operations and prospects.

The majority of Electric Last Mile Solutions’ risk factors fall under the Finance and Corporate category, with 44% of the total risks. That is above the sector average of 39%. The company’s stock price has declined about 47% year-to-date.

Analysts’ Take

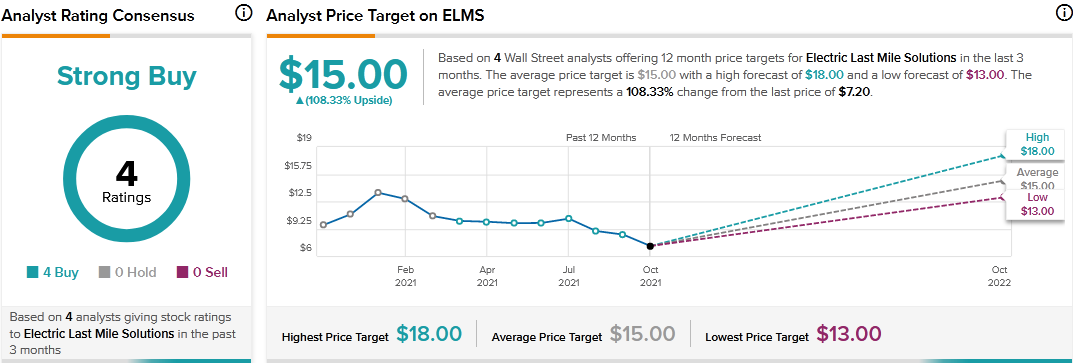

In September, Colliers Securities analyst Richard Ryan reiterated a Buy rating on Electric Last Mile Solutions stock with a price target of $13. Ryan’s price target suggests 80.56% upside potential.

Consensus among analysts is a Strong Buy based on 4 Buys. The average Electric Last Mile Solutions price target of $15 implies 108.33% upside potential to current levels.

Related News:

Kansas City Southern Highlights New Risk Factors Amid Pending Merger

Lordstown Motors Highlights New Risk Factors Ahead of Endurance Truck Production

Restaurant Brands Q3 Earnings Preview: What to Watch