Dublin-headquartered Cardinal Health (CAH) is a distributor of healthcare supplies, including drugs and laboratory products. It recently partnered with Zipline on a program that will use drones to ship supplies to customers and speed up deliveries to pharmacy locations. This comes after Cardinal extended its pharmaceuticals distribution agreement with CVS Health (CVS) to June 2027.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this in mind, we used TipRanks to take a look at the latest financial performance and understand the newly added risk factors for Cardinal Health. (See Insiders’ Hot Stocks on TipRanks)

Q1 Financial Results

Cardinal reported revenue of $44 billion for its Fiscal 2022 first-quarter ended September 30, surpassing the consensus estimate of $41.9 billion. Revenue was $39.1 billion in the same quarter last year. It posted adjusted EPS of $1.29, missing the consensus estimate of $1.33.

Cardinal ended Q1 with $2.5 billion in cash. It plans to repurchase $3 billion worth of its shares over the next three years. (See Cardinal Health stock charts on TipRanks).

Risk Factors

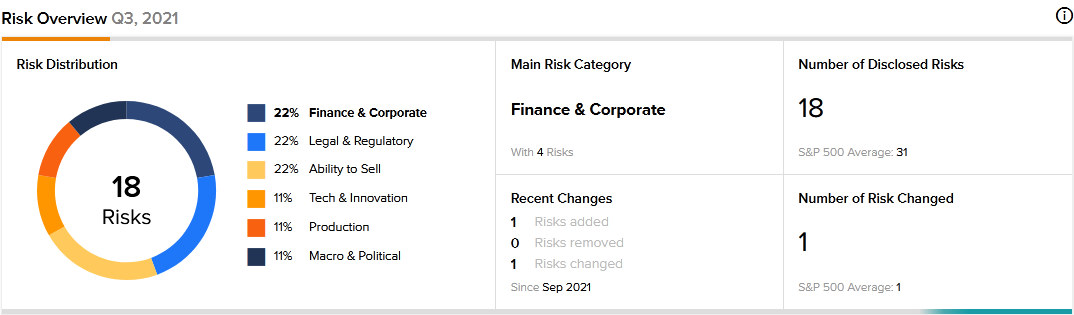

According to the new TipRanks Risk Factors tool, Cardinal Health’s main risk categories are Finance and Corporate; Legal and Regulatory; and Ability to Sell, each representing 22% of the total 18 risks identified for the stock. The company recently added one new risk factor under the Production category, which accounts for 11% of its total risks.

Cardinal informed investors that it may lose important employees because of COVID-19 vaccine mandates, which could, in turn, adversely impact its business and financial condition. It explains that it required certain groups of its workers in the U.S. and Canada to get fully vaccinated by December 2021. The government then issued a more stringent vaccine mandate increasing the number of Cardinal Health’s employees required to be fully vaccinated. The company warns that implementing the vaccine mandates may cause some of its employees to leave, and replacing them may be difficult.

Cardinal Health has updated another Production category risk that it had previously highlighted to remind investors of the vulnerability of its manufacturing operation. The company tells investors that it uses materials such as cotton, latex, and pulp in its manufacturing. The prices of these materials fluctuate significantly and could drive up its manufacturing costs. Further, oil and gas prices affect its distribution costs. The company says that it has recently experienced such cost increases, which have adversely impacted medical segment profits. Cardinal expects these challenges to continue. Cardinal Health further cautions that its manufacturing activities may be disrupted, and it could lose revenue if its raw material suppliers cannot deliver on their commitments.

The Production risk factor’s sector average is 11%, the same as Cardinal’s. Cardinal’s stock has declined about 13% year-to-date.

Analysts’ Take

Following Cardinal’s Q1 earnings report, UBS analyst Kevin Caliendo reiterated a Buy rating on Cardinal stock but lowered the price target to $61 from $66. Caliendo’s reduced price target suggests 30.31% upside potential.

Consensus among analysts is a Moderate Buy based on 2 Buys and 5 Holds. The average Cardinal Health price target of $56.43 implies 20.55% upside potential to current levels.

Related News:

Omnicell to Acquire ReCept for $100M

BMO Announces Financial Deal with Boralex

Scotiabank Named Canada’s Bank of the Year