The Director of Scholar Rock Holding Corporation (NASDAQ: SRRK), Amir Nashat, has recently increased his stake in the company. Following the move, shares of this $307.7-million biopharmaceutical company slipped 4.3% to close at $5.96 on Friday.

Per the TipRanks Insider Trading tool, the Director purchased 1,197,992 shares of Scholar Rock for $4.90 each share. The total value of this Informative Buy transaction was $5.87 million. In addition to this transaction, multiple other transactions (Uninformative Buys) were executed last week.

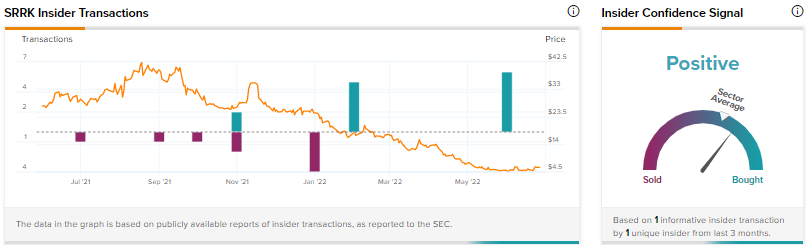

A pictorial representation of the last week’s transactions is provided below.

Meanwhile, the TipRanks Insider trading tool suggests that the confidence of insiders in SRRK stock is Positive, as corporate insiders have bought shares worth $5.9 million in the last three months.

Other TipRanks Data

Another tool offered by TipRanks suggests that hedge funds have increased their holding in SRRK by 24.9 thousand shares in the last quarter. The hedge fund confidence signal on the stock is Neutral.

The increase in holdings by the corporate insiders and hedge funds signals solid prospects for SRRK. Also, the Street is unanimously optimistic about SRRK and has a Strong Buy consensus rating based on three Buys.

SRRK’s average price target of $37 suggests a whopping 520.81% upside from the current level. Over the past year, shares of Scholar Rock Holding have plummeted 80.7%.

A few days ago, Do Kim of Piper Sandler reiterated a Buy rating on SRRK while lowering the price target to $19 (218.79% upside potential) from $28.

Conclusion

The recent insider buy transaction of Scholar Rock’s shares might signal the optimism around the $205 million worth of registered direct offering, positive data from the TOPAZ trial (Phase 2), and healthy pipeline projects. A proper study of the corporate trades on SRRK stocks might help investors form an opinion on the stock.

Interestingly, investors interested in other stocks might also benefit from a list of Daily Insider Transactions, Insiders’ Hot Stocks, and Top Corporate Insiders, which is available on TipRanks.

Read full Disclosure